There are strong arguments against cryptocurrency. Just like there are strong criticisms that can be leveled at Amazon or a favourite programming language - nothing in life is just upside. Below I've tried to capture some of what I regard as the best criticisms, which are: energy use, e-waste, gambling, scams, security, and uncertain regulation.

Few things in life are cleanly positive, whether that's diamond engagement rings sourced from vast mines or the clothes we buy. But by grappling with the negatives, we can better see why the positives are worthwhile, and with cryptocurrency being valued globally at over $1 trillion, there's never been a better time for a skeptical look.

A. Mining: Energy & Semiconductors

The digital process of mining cryptocurrencies is almost always done using proof-of-work

, which depends on using vast amounts of energy. This is a favourite argument of journalists because energy use is something most people have some understanding of. But the problem is usually worse than energy, because the devices that burn energy are made from semiconductors and plastics that involve significant resource usage. Ethereum mining has had a material impact on the availability of GPUs because so many have been purchased for mining uses. Later they're discarded as e-waste

when the next generation of technology comes online. This is a bigger problem than most people recognize. For NVIDIA, one of the largest manufacturers of GPUs, this use case is so big that they state it as a material risk in their 2021 annual report:

For example, our GPUs for gaming are capable of digital currency mining. Demand and use of GPUs for cryptocurrency has fluctuated in the past and is likely to continue to change quickly. Volatility in the cryptocurrency market, including changes in the prices of cryptocurrencies, can impact demand for our products and our ability to estimate demand for our products. Changes to cryptocurrency standards and processes including, but not limited to, the pending Ethereum 2.0 standard may also create increased aftermarket resales of our GPUs and may reduce demand for our new GPUs.

"Risks Related to Our Operating Business", 2021 Annual Review, Page 16

NVIDIA even makes a special version of their hardware that's designed for cryptocurrency mining. Canadian publicly traded cryptocurrency mining company Hut8 is one of their customers, having purchased $30 million (USD) of NVIDIA's special purpose mining hardware in March of this year. Two weeks after the purchase Hut8 entered into a power purchase agreement to buy up to 100MW of power, showing the relationship between semiconductors and power consumption. More mining hardware requires more power, and more mining requires more electronics to be manufacturered. No one knows how much is being used, but it's fair to say that billions of dollars has been used to buy cryptocurrency mining hardware with an enormous environmental footprint globally. Computer hardware doesn't appear out of nowhere. It's assembled out of materials mined around the world, often in countries far less developed than those of where they're purchased.

B. Gambling Away Hard-Earned Money

Gambling addictions ruin lives, and many people don't know their limit

or play within it

(the slogan of the Ontario government's gambling company, OLG). Undoubtedly, many people buy cryptocurrencies because of the volatality that so many critics decry. While I don't think that volatility is necessarily bad, losing significant amounts of money on gambling is bad for the person who loses it. Is it speculation

or is it gambling? Many people are also using the stock market for gambling (re: GameStop stock), and it's difficult to sort out what's gambling vs. investing vs. purchasing for use, gambling is an aspect of the market.

For some parts of the cryptocurrency space, gambling is the main event, with literal casinos or lottery schemes on-chain. Whatever exactly the scope of gambling is within the cryptocurrency space, it's more than metaphorical. And wherever there is gambling there are people losing more money than they intended to, sometimes with profound consequences.

C. Use By Scammers

Not everyone in the world wants to create value for other people and get paid for it. Some people prefer to steal, and the Internet is notoriously full of thieves and scams. Everyone's spam folder is replete with examples. These criminals are constantly looking for new means to part people from their money, and cryptocurrency has been used to steal millions of dollars from Canadians every year. Although often wildly exaggerated by critics, it is true that a portion of cryptocurrency use is crime. But it's crime that's targetted at cryptocurrency users, not crime using cryptocurrency, because the scams are typically forex investment schemes or fake business investments overseas. The scammers get their victims to send them large amounts of money using cryptocurrency, usually with the promise of extravagent returns. Once transferred, the transaction is quickly finalized and irreversible.

Another scam that's resulted in large losses for Canadians is tokens that are a scam from the beginning or became a scam later. These are often called rug pulls

, and the vast majority of these are perpetrated by people outside of Canada against those inside Canada. A lack of law enforcement resources to pursue rug pulls is part of the reason for the losses, but it's also the naivety (or greed) of buyers/investors. Many people are looking to get in on the ground floor of a new digital asset, hoping for huge returns later like has been experienced with more mature cryptocurrencies. In one way, these scam tokens can be regarded as counterfeit digital assets, a bit like counterfeit pharmaceuticals hawked by email blasts.

Surprisingly, some scam activities can also be considered gambling, as there are people who deliberately try to participate in pump and dump

scams involving minor digital assets, hoping that they'll be on the right side of the market before the scheme collapses. However exactly the scam works, or people's motivations, the truth is that scammers are out there and they're looking to get a hold of users' cryptocurrency.

Of course, the vast majority of the world's scams don't take place using cryptocurrency. The world's largest ponzi scheme, ~$65 billion (USD) was uncovered in late 2008, and took place entirely within the realm of the regulated securities markets. But the novelty of cryptocurrency, the rapid price appreciation, and the global nature of this makes it particularly problematic. It's likely that scams involving cryptocurrency have grown in proportion to legitimate interest in it.

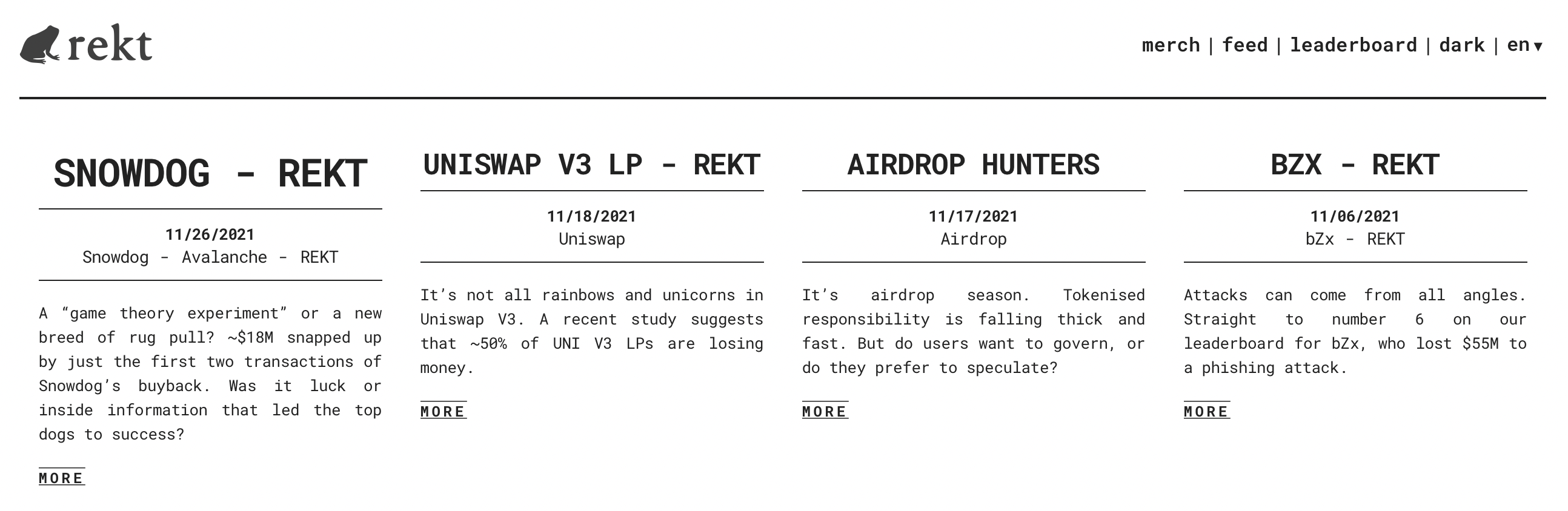

D. Difficult To Secure

It's hard to safeguard cryptocurrency against the many types of attacks on computer systems. Although people are used to having their accounts hacked, debit cards stolen, or parcels stolen, this is a new way to lose that many people are not prepared for. In some cases they entrust third-parties like Coinbase, who may fail to protect their digital assets. In other cases it's their wallet software that is hacked, or they give the backup phrase (mnemonic

) to someone who turns out to be less than trustworthy. Billions of dollars of cryptocurrency has been stolen through simple and sophisticated attacks. There are even specialty news sites dedicated to showcasing certain kinds of hacks, such as rekt.news (which tracks DeFi hacks).

As digital assets grow in popularity in North America there's been a rise of new services to safeguard them. But because of the fundamentally insecure nature of most computer systems, where even the CIA's cyberweapons have been hacked and distributed, there will continue to be losses. New insured offerings and better use of hardware wallets is helping, but for most people it is difficult to safely store cryptocurrencies, even as we approach the end of 2021. Thirteen years after Bitcoin was invented, there's an even more pressing need for improvements in computer security.

Undoubtedly, losses due to security problems with non-crypto payment methods like credit cards and debit cards are far larger than losses due to improperly stored crypto. The accounting profession of Canada does an annual survey of fraud and claims that around 1/3 of Canadians have personally experienced fraud (of all types). As cryptocurrencies become more widely adopted and held, this problem is likely to grow without significant improvements in user education and the technologies that they can use to protect themselves.

E. Uncertain Regulatory Environment

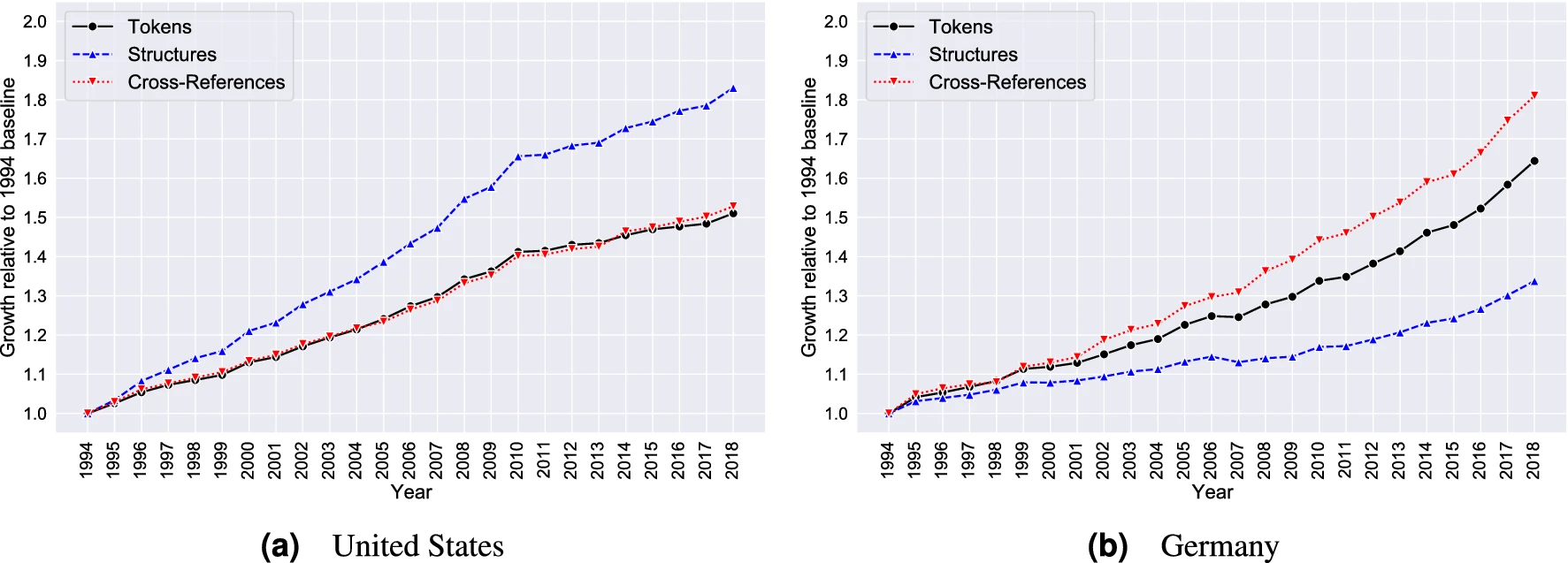

The vast majority of Canada's websites and businesses can be confident that they are on the right side of the law. Mostly because there aren't special laws that target their activities, since the general legal position in Canada is that something is lawful unless there's a rule against it. Government officials usually avoid making special rules for certain types of businesses because rules of general application are easier to follow and ensure prosperity. But laws are proliferating, with ever more rules that apply to ever more aspects of life in Canada. Numbers are hard to come by, but likely follows the trend of Germany and the United States, where the quantity of laws expanded by 50-80% (depending on the measurement used) in 1994-2018.

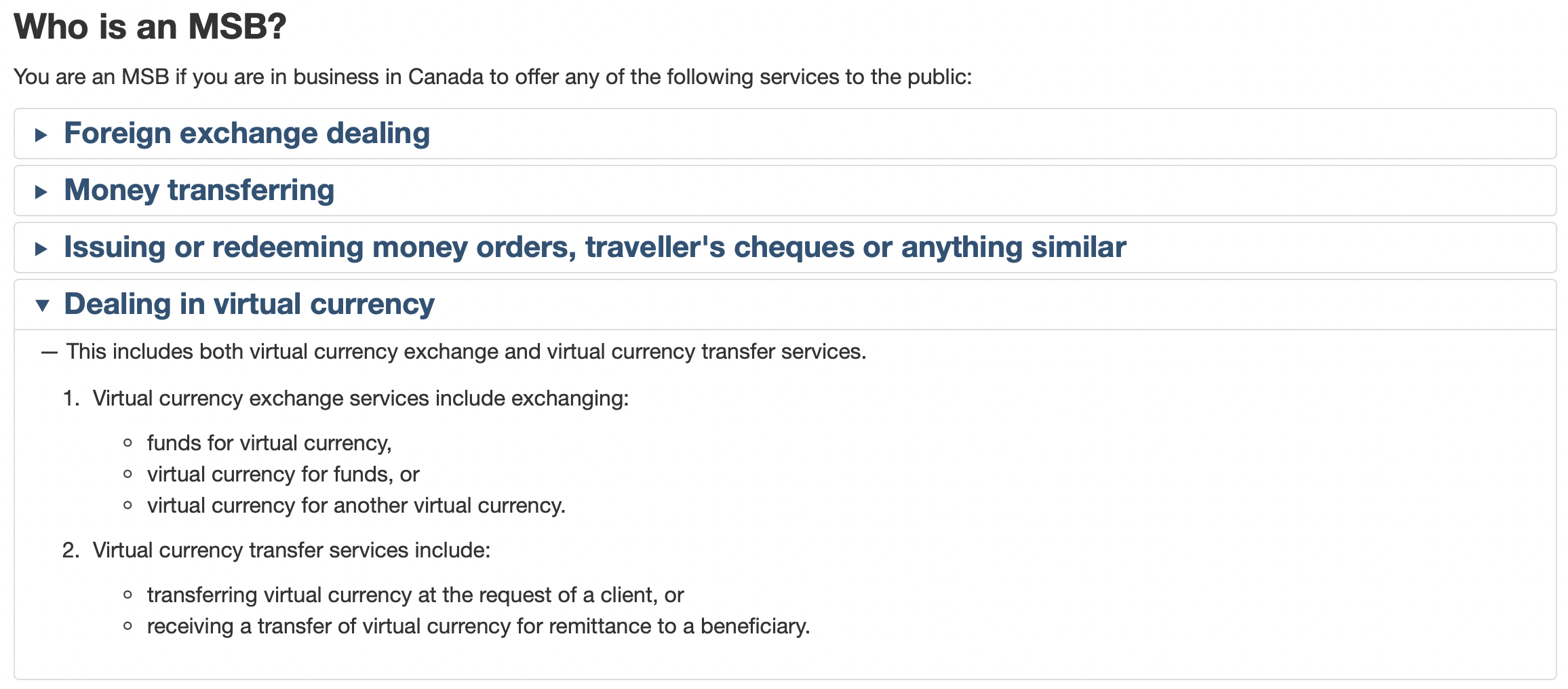

As governments look for new areas to control through legislation, the novelty of cryptocurrencies was always sure to attract attention. In 2015 the first law in Canada was passed that specially regulated cryptocurrency, bringing it into the PCMLTFA as a type of money for the purposes of anti-money laundering/anti-terrorist financing regulation. This regime has expanded significantly over the last six years, with new regulations and guidelines. Over the last couple years, securities regulators have been developing their own rules that they are attempting to impose on dealers and exchanges. The Canadian investment industry's private association (which plays a role in regulation, delegated from securities regulators), IIROC, is also developing rules, modeled on those used to self-regulate investment dealers. Tax laws are also being specifically amended to create rules for sales tax for virtual currencies. These tax rules come on top of other types of digital economy taxes being introduced worldwide (e.g. Japan's 2015 sales tax on cross-border digital sales).

More rules means more change, and not the type of change that companies generally hope for. As bureaucrats play a larger role in the industry there will be new costs and more companies that need to consider hiring lawyers. This is great for the legal profession, and some companies do cheer on regulation (generally hoping that their competitors won't be able to play the game as well), but may scare away entrepreneurs or international companies that prefer a more stable or less regulated environment.

However someone feels about the role of government in business affairs, an uncertain and rapidly changing regulatory environment is generally not a positive factor for an industry. And fo the cryptocurrency space this problem is multiplied by the enormous number of jurisdictions worldwide, all hoping that their rules will be the ones that companies follow. This creates uncertainty for everyone who has a global user base, because even the best resourced companies can't monitor the entire world's legal systems for changes. Where there is risk there will generally be less people willing to do something, and as regulations increase and proliferate this will likely impact the utopian, one-world vision that many people in the cryptocurrency space have in mind.

Conclusion

Is the juice worth the squeeze? Obviously for the hundreds of millions of people worldwide who have gotten into cryptocurrency over the last few years, the answer is a resounding yes. They've done so because of the benefits, which I wrote about in a previous blog post. But the problems are real, and some are very difficult to solve. Computer insecurity is a decades-old problem (that may never be solved). Laws will continue to balkanize the world's online offerings, and as the digital economy takes hold, this problem will likely get worse for innovators. Financial crimes are mentioned in the Old Testament. But the harms from energy and hardware use can be minimized, and many cryptocurrency miners are investing in renewable energy (which can sometimes be cheaper than the world's favourite cheap power source: coal). None of the problems discussed in this blog post are particularly unique observations, and industry players are always looking for solutions. But with environmental disasters worldwide, and global warming threatening the existence of long-standing patterns of human, animal, and plant life, improvements to the environmental footprint of cryptocurrency can't come soon enough.

Energy and e-waste are the two best arguments against the use of cryptocurrencies. The environmental footprint of the electronics industry is atrocious, and it's not particularly better in the world of cryptocurrency mining (although probably illegal dumping is less of a concern when it comes to industrial-scale cryptomining facilities). Minimizing the use of electronics in cryptocurrency is important, and improving their energy efficiency should probably be the next priority.

Whether or not the pros and cons balance off is largely a values judgement, and a difficult one to make without knowing the many uses of digital assets. There is no right answer about whether cryptocurrency is good or bad, as with most complicated worldwide phenomenon.

Image Credits

The image at the top of workers burning electronics to extract copper was taken by Muntaka Chasant, and then cropped to fit the format of this article. The original can be found here: https://en.wikipedia.org/wiki/Agbogbloshie#/media/File:Agbogbloshie,_Ghana_2019.jpg.

At the bottom of Section A is an image of a cobalt mine in Congo, taken by Siddharth Kara. The photo is cropped to hide the faces of some of the people working at the mine but the original can be found on the Guardian's website at https://www.theguardian.com/global-development/2018/oct/12/phone-misery-children-congo-cobalt-mines-drc

The "CasinoNight" image invite is from a Decentraland events listing organized by "Murphjestic": https://events.decentraland.org/event/?id=04ae1690-8376-494e-8d8d-eaf0cf29d8ad

The image of Bernie Madoff is from a CNBC article linked from the image.

The graphs of the increase in the quantity of laws in Germany and the United States was taken from a Nature article that is linked from the image.