Several tokenized stock/ETF offerings have been created and gone live on public blockchains in the last few months. What this means is that people can buy, on public blockchains, (without any KYC, account opening, etc.) various US stocks and ETFs. This is a huge milestone, and it's been in the works for years. It's incredibly challenging to do this because it requires connecting several jurisdictions with an eye to creating tokenized stocks that can escape the sandbox and then come back to the sandbox for redemption. This is a legal triumph, not a technical one, because the basic idea of stocks on chain

is not a difficult one. This article explains several different routes being used to create these tokens.

Introduction

The three routes that are explained below are: 1) BVI Ownership + USA Security Interest 2) EU Prospectuses 3) US Derivatives. If you read the websites of the companies involved, absolutely none of them will describe their products like this, and none of them provide an upfront explanation of how the magic works. But because they're required to explain risks, and in some cases, post a prospectus, the details of how these models work can be found online. Other details I've gathered from partners of these companies, which have posted quite helpful legal explanations that go beyond what the companies themselves post on their sites.

Each model has its pros and cons. Some of them have advantages for users, others have advantages for the creators. Interestingly, all of them seem to have come online around the same time, as part of the global race for tokenized securities. The key to understanding these is that they are not simply creating securities (which is rather boring, and highly regulated), they are creating tokens which represent a security, and the tokens can be moved around on-chain without approval. This is not at all like having a brokerage account.

Model 1: BVI Ownership + USA Security Interest

Ondi.Finance is one of the major players in the global tokenized securities space. They've created a BVI corporation that owns the underlying stocks directly and then they have a USA-based trust company called Ankura Trust Company that monitors the accounts and can step in to seize the assets for the benefit of the tokenholders. That's an interesting twist on the model, which is aimed at achieving what lawyers call bankruptcy remote

status (i.e. that the failure of the company/organizers doesn't also take down the entity that holds the assets that are supposed to be held by token holders). The token issuer is Ondo Global Markets (BVI) Limited, which, as a BVI company, is charged a 30% withholding tax on dividend distributions. But, for many stocks/ETFs, the dividends are such a minimal (or zero) component of the return, so this may not be much of a drawback in practice.

This is a relatively simple structure, and it uses a common law jurisdiction that's fairly well known to lawyers in this area. Campbells did the legal work for this product.

Model 2: EU Prospectuses

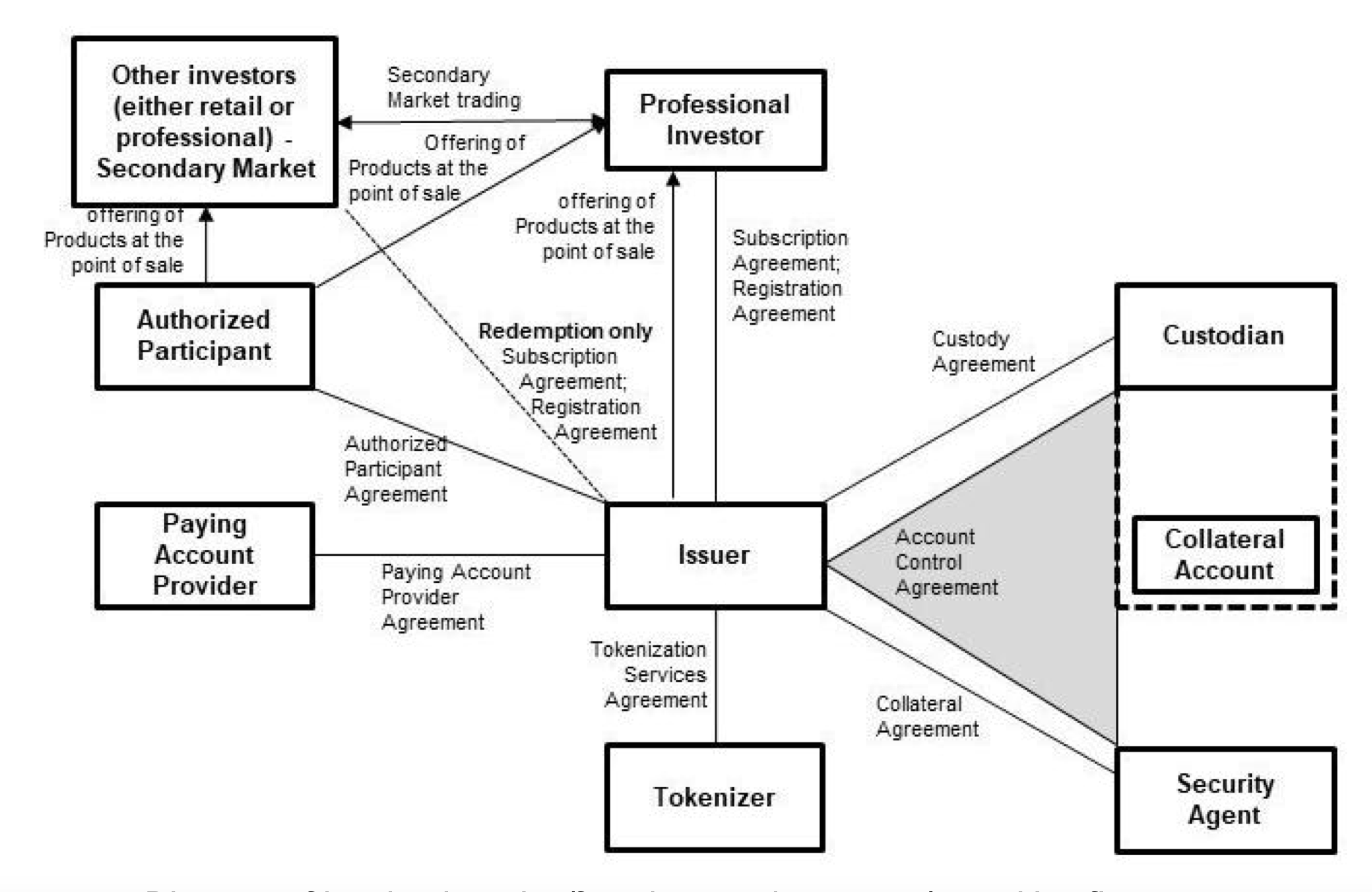

There are several jurisdictions in the EU that have been used for unusual types of securities, such as crypto staking securities, and now stock/ETF securities, which are then turned into tokens. This is the model being used by Kraken for their tokenized stock line of business, offered by Payward Digital Solutions Ltd., a Bermuda company licensed by the Bermuda Monetary Authority. They're working in partnership with Backed Assets (JE) Limited, a Jersey corporation that works with Backed Finance AG, a Swiss corporation based in Zug (a familiar jurisdiction in the crypto space). There's also a custodian in Switzerland, Maerki Baumann & Co. AG, which is a licensed bank. The complex relationship is spelled out in the Securities Note

for this product. Page 46 of the note shows a diagram of the structure of the product:

Page 65 of the Securiteis Note explains that under the Jersey-USA tax treaty this counts as a resident corporation that doesn't have any dividend withholding tax.

The Securities Note itself is issued in Liechtenstein. So, altogether, we have three different EU countries and Bermuda involved in this token product.

Model 3: US Derivatives

Gemini, a US crypto platform, launched their tokenized stocks offering using dShares, which are OTC derivatives sold to foreign purchasers under Reg S, which are then sold by Gemini Intergalactic EU Artemis, Ltd., which is registered in Malta under the Malta Financial Services Authority. Malta is a common choice for unusual products because it benefits from passporting within the EU, which is how this is being sold to people in the EU. Dinari, Inc., a US company, makes the dShares derivatives contracts.

No Americans Or Canadians

Americans and Canadians are forbidden from buying all of the above products. And yet Americans are behind these products. Why? Because the idea is that the tokens end up on-chain and then anyone can buy them. It doesn't particularly matter how many people can buy and sell these with the companies, as long as a few people can, which keeps the prices about the same as the underlying assets.