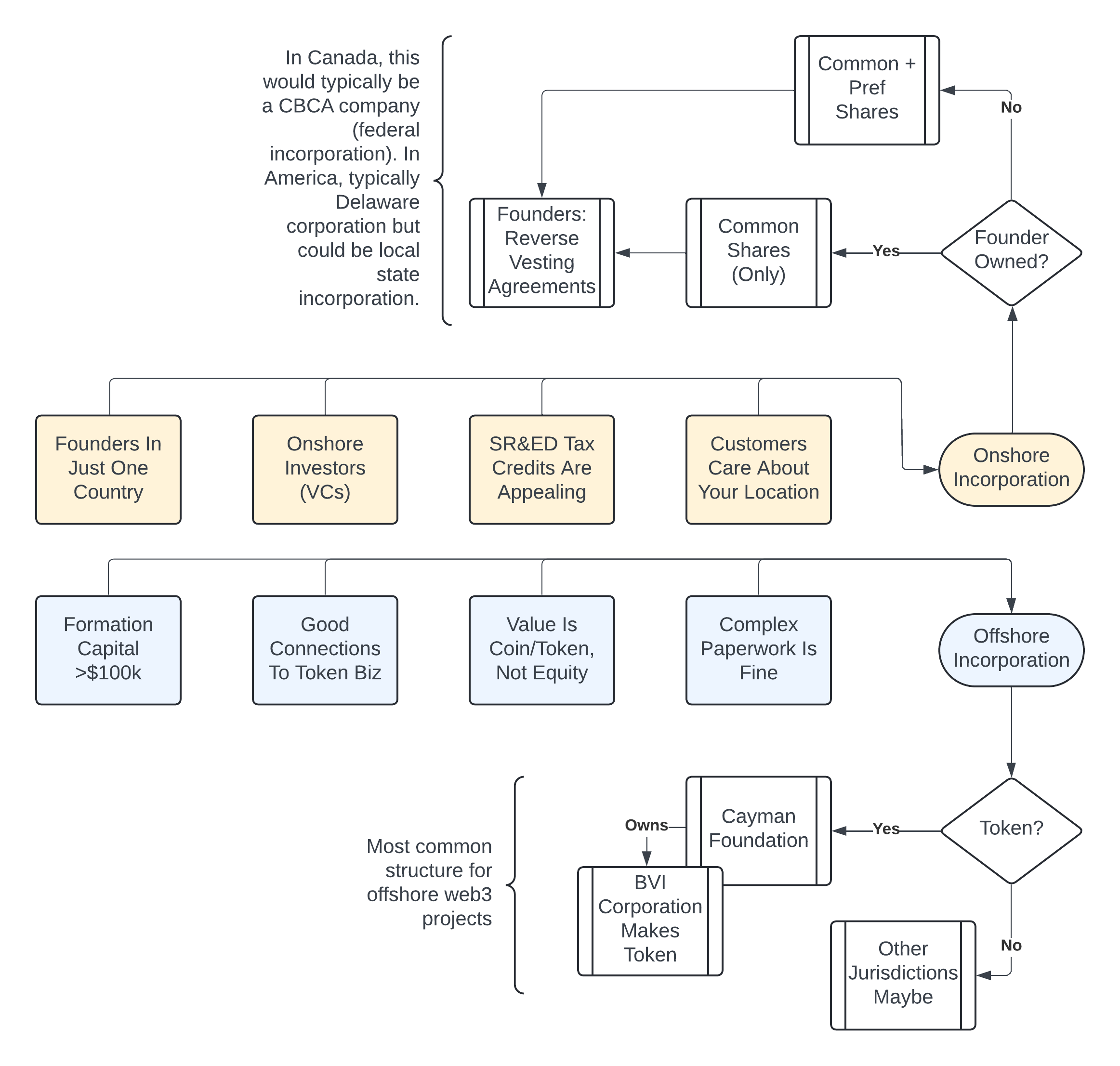

One of the most common questions I get from founding teams of blockchain projects is: where should we set up our business? People expect this to be an easy answer. And there is a common answer: Cayman foundation company (holding company) that owns a BVI corporation (which issues token). But there's a lot more to being a lawyer than suggesting what most people do. And not everyone will be well-served by following this path.

The diagram above shows some of the key decision points for where to incorporate. For many kinds of businesses, they'd be just as well or better-served by a local corporation than one in a country they've never been to and can't find on the map. I particularly try to steer people away from the particularly exotic like Seychelles or Mauritius. These countries are flagged as high risk for money laundering, and many companies set up in these places will be uninvestable. But is that needed? For founders who start with enough of their money, and don't plan on seeking investment (because they'll be selling tokens or making money from their service), this may not be a factor. This also helps with the high startup costs of setting up in these jurisdictions (properly).

There are a number of easy incorporation services for setting up in unusual countries, like Panama, but the established law firms for these regions have complex onboarding processes and high costs. The paperwork can be daunting for founders. No matter how much I warn people they're almost always surprised by how complex it is to do business (properly and lawfully) in places like the Cayman Islands. For example, banking services can be difficult or impossible to get locally. Paperwork requirements are quite high in these places and the rules are often focused on money laundering risks that local companies don't face. A Canadian federal corporation will generally be able to open a bank account, and a law firm onboarding them won't have twenty pages of paperwork about ultimate beneficial ownership. There's a high level of convenience to local incorporation.

Local companies can also benefit from tax credits that aren't available to foreign companies. This can offset taxes. Taxes might not even be a problem if the business is loss-making (and the value is in the tokens), although sales tax is often a concern locally. This isn't a concern in offshore places, which generally don't have income or sales tax - which is why people often pick them. Taxes are generally levied on a net basis, so startups are often not too concerned about corporate income tax when they start. And they might become more successful by being local companies, in the cases where people care about who they're dealing with. For example, some companies won't do business with offshore entities, or if they do, they subject the payments to significantly more scrutiny.

For a company where the value is in the equity, the founders will almost always be set up with reverse vesting agreements. These agreements make it so that if they leave they don't take their allocation of the company with them. This helps to align effort to long-term success. In most cases this can be common shares (at least to start). If there's an upfront investor they might want preferred shares. But I caution startups on attempting to do too much planning about the future. It's never certain what path a company will take, and it's usually possible to amend share classes as part of investment transactions.

Onshore companies are always simpler from a corporate perspective. They're easier from a banking perspective. The only area that might be more complicated is tax, but even then, the tax situation for an offshore company in relation to founders in high-tax countries is not simple. This often requires costly tax advice (and anyone who does this without tax advice is recklessly moving forward). There are increasing requirements in this respect globally as countries attempt to capture more of the wealth of the people in their jurisdictions. Essentially, tax and complexity will be an issue no matter where a business is, because of the relationship between the business and its owners. Picking a foreign place for simplicity of tax may not necessarily be the best call.

Many founders who speak to me are very concerned about the laws of their own country either now or in the future. It's uncertain what might happen in terms of regulation, but in some cases their business will not be a part of any particular regulatory scheme. I think too many people are simply scared of the complexity of the legal system in their home jurisdiction and pick a foreign one instead as a means of opting out. There may be some truth to this idea, but in a lot of cases there really isn't an opt-out of the laws, because it's usually the laws of the customer that apply with respect to that customer. A business that can't offer its service legally to Canadians from Canada won't be able to do it from Mauritius either. At least, lawfully. And if the considerations aren't about lawfulness then they don't need a lawyer in the first place!

The final factor to consider is access to courts. Foreign countries may not offer the same level of legal protection for founders, investors, or other participants. This is one reason why investors often invest in their home jurisdiction (or a neighbouring country they know well). The legal system in Canada may not be the best in the world, and it may not be fast, but it's understandable and really does offer justice to many people who are wronged. There's much less assurance of a court in Malta protecting the interests of participants, or at least in the same manner that they expect as Canadians. The legal system of a place is a consideration that most people overlook, until they need it. It's a factor to consider in where you should locate your business.

As always: location, location, location. Founders aren't wrong to wonder about this. But the answer isn't simply Cayman + BVI, and too many web3 projects/businesses have probably gone abroad when they could have set up locally. Government pronouncements often scare them off, or what they've heard on Telegram, but the reality is often surprisingly better than people think. In any event, the choice of where to set up is one that should be done based on the actual facts of the business to be set up, not on cargo culting.