Small businesses employ 70% of private sector employees in Canada. They're the lifeblood of employment, but also the key to a dynamic economy. That's fairly accepted in Canada politically and in the media. But what's not accepted is the role that investment laws play in restricting access to capital.

70% Of Employment, 1% Of Investment

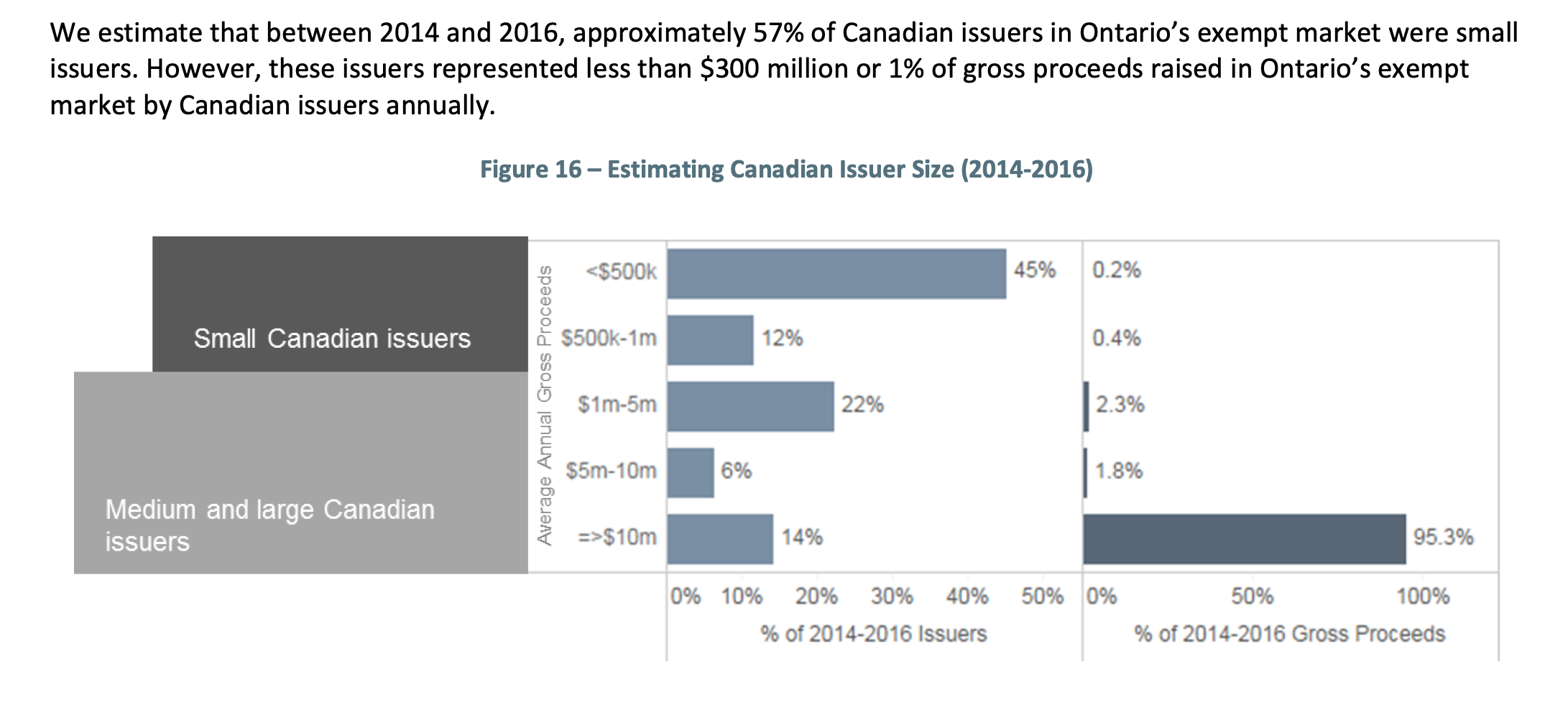

Only 1% of gross proceeds from the exempt market in Ontario goes to small businessess (pg. 15 of the OSC's 2017 exempt market report). Hearteningly, small issuers are 45% of issuers, but the total raised and even the percentage of issuance is significantly less than what would be expected by the role of small businesses in private sector employment. This is the "small issuer problem".

Solving the small issuer problem in Ontario could play an essential role in Ontario's recovery from the COVID-19 disruptions that have wreaked havoc on businesses (and especially small ones).

Accurate Statistics?

Because of the way Ontario does investment reporting, the numbers above probably underestimate how much money is flowing to small businesses. Undoubtedly a huge amount of financing is private with minimal or no paperwork for the many family businesses that make up Ontario's small business sector. But however off the numbers are, there's a general sentiment that the rules are restrictive and difficult to follow. And this sentiment isn't for nothing! Investment laws are complicated, and investments in small businesses are risky. Although small business investment is probably significantly more than 1% of total investment into businesses in Ontario, it's very likely much less than the proportionate contribution to employment.

The Patch Approach: Time For A Rewrite?

Restrictive investment laws are partly the result of a series of legal patches over the years in response to various frauds and scams. But are frauds equally likely in all business sectors? Can we reimagine investment laws to better channel funds to small businesses while maintaining a similar risk profile as the current system (which is not 100% effective at stopping frauds or scams)? After nearly a century of patches, is it time for a rewrite?

If there was a rewrite, would that be enough? Probably not. Because investment laws aren't the sole problem. There's also larger trends like real estate investing, and a lack of standardization/digitization that creates significant transaction costs that are only partially related to laws (e.g. financials, due diligence, etc.).

The Role of Real Estate

Part of the small issuer problem is the role of real estate in the Canadian economy. Why would an investor put money into a small business when the government provides so many incentives to invest in real estate? A successful doctor would much prefer to buy a condo using government-insured leverage than an unlevered investment into a local businesss. The outsized role of real estate, and government policies that benefit real estate prices, looms behind the small issuer problem.

Conclusion

Solving this could provide a huge boost to employment and prosperity, and in a way that's broadly shared amongst Canadians. Investment laws are one piece of the puzzle but truly addressing this would require that all levels of government take a hard look at whether existing rules and policies are helping or hurting the job-creating small business sector.