Silicon Valley Bank (SVB) failed on Friday. With around $200 billion in assets, this is one of the largest bank failures in US history. It has particularly affected the cryptocurrency space because SVB was especially concentrated in the technology sector. At least one major stablecoin used SVB to hold a portion of their cash: USDC. Circle Internet Financial, the corporate group behind USDC, announced that $3.3 billion USD is stuck in SVB, which is currently under the control of the FDIC (US federal government).

USDC Value Slipped On Crypto Markets

The sudden closure of SVB on Friday caused Circle to stop redemptions of USDC on a 1:1 basis and the secondary market price of USDC plunged from $1 to as low as $0.91 on Saturday morning. This nearly 10% drop is unheard of in the history of USDC. Despite constant fretting by regulators about stablecoins, the cause of this was instability in the banking sector (not the cryptocurrency sector). This is a risk that's almost impossible to eliminate because a good stablecoin should have lots of money stored in a secured place, and it's hard to think of a better place than a bank. Previously, some companies, like Coinbase, even offered direct trading of USCD on a 1:1 basis (which were halted on Friday as the price fell).

How Did SVB Fail?

SVB's failure was caused by bank regulations (and likely poor risk management, to some degree) that required them to purchase safe

assets like government bonds and mortgage-backed securities. These assets are safe in the sense that the principal isn't at risk, but not safe in the sense that they can't decline in value. And they did. Silicon Valley Bank's securities, some of which had a ten year duration, have plunged in value because interest rates have skyrocketed. When rates go up, the value of lower yield instruments falls proportionately because no one wants to buy a low-yield security when they could buy a high-yield security. Rates on bonds have tripled from the pandemic lows. Rising rates caused SVB to lose $1.8 billion USD on a $21 billion sale of securities that they conducted to satisfy withdrawals. The withdrawals occured because of doubts about the bank and a general drawing down of cash deposits/credit lines in the tech industry (which has been hit hard by a drop in investment activity over the last year.)

SVB Should Be Back Soon

Silicon Valley Bank's abrupt closure will probably not be for long. The FDIC (similar to Canada's CDIC) announced they'll reopen on Monday, and they have an orderly plan for dealing with bank failures. So Circle should be able to get at the funds relatively quickly, but even a temporary lack of funds can cause a stablecoin to move far off the 1:1 ratio that custoemrs are looking for.

It's unclear what the lesson from this failure is, since SVB was a respected bank until last week. Larger banks might be a better place to put money for stablecoins, so perhaps in the future they'll place with the bigger players, but many of those banks have not been interested in banking stablecoins. Circle's statement about USDC and SVB claims that they moved funds to BNY Mellon, which has around $45 trillion under custody.

Current Price of USDC

As I write this post, USDC is back to $0.964 per token. That's far from the ideal of 1:1, but pretty resilient considering the upheaval of the SVB failure.

How Does USDC Work?

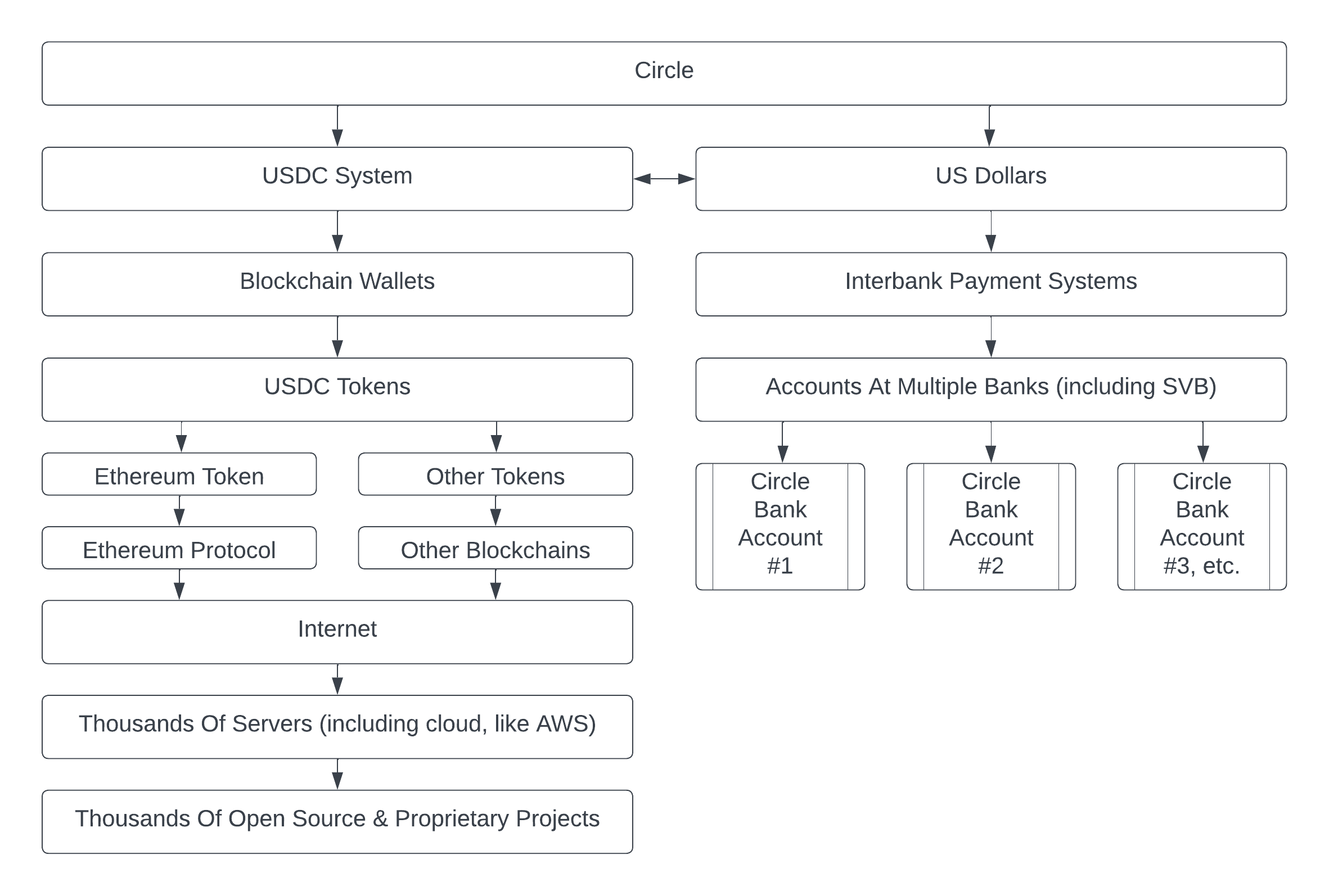

The diagram at the top of this page is my illustration of how USDC works. It's a system that works across multiple blockchains, which essentially provides a stable token that has a value of $1 (ideally). The tokens can be freely moved around the world by anyone, but Circle only provides redemption to certain people/businesses. So long as some people can redeem at 1:1, it's not hard to maintain the $1 price, because it's an obvious arbitrage trade for anyone who can redeem. So it's a quasi-decentralized system in which the vast majority of participants never interact with Circle (or any other company). Users of USDC never interact with the banks that ultimately store the money that's held to support the creation of USDC tokens. Most of the time, this is of no consequence. Undoubtedly this weekend many companies holding large amounts of USDC have been wondering if they might have some sort of claim or means of converting their tokens into dollars directly with Circle, but with the price returning to $1 these questions will likely fade away.

Future Solutions

One solution proposed for this problem is to have a special kind of narrow bank

that just simply holds dollars. CBDC dollars could be another solution. But at the moment, banks are the safest place for most people to store money. But they're a little less safe than commonly assumed.