Most media reports about the spending related to Coronavirus in Canada have focussed on the Government of Canada's enormous spending. But there's much quieter spending that's been taking place through the Bank of Canada, and some aspects of it, such as a large increase in the amount of money in Canada, the role of TD Bank, and large purchases of mortgages, have escaped notice. Bank of Canada assets and liabilities have increased by $430 billion in about six months. This deserves a lot more attention than the news has given it, and the specifics of some of the programs should give many Canadians pause as to whether their money is being wisely expended. Given the widespread suffering of people in Canada due to Coronavirus, there's an even greater duty for our government to be transparent about who has gained and lost through its spending, and how.

Addison Cameron-Huff, Blockchain Lawyer

Thoughts and opinions of a Toronto-based cryptocurrency lawyer who's worked in the industry since 2014.

Follow @aCameronhuffUse Generative AI To Explore

Launch Generative AISeptember 8th, 2020

Canada's Money Supply, Coronavirus, and Bond Buying

August 21st, 2020

A Canadian Crypto SRO

The Canadian cryptocurrency industry should be one of the strongest in the world, being the birthplace of Ethereum, close to the US market, a good bridge from China/HK, generous tax credits for R&D work, and many other advantages. But the industry has been plagued by a poor understanding of regulatory issues, unusual viewpoints put forward to government, and repeated work that ought to be shared. These problems could be addressed through the creation of a Canadian self-regulatory organization (SRO).

What would a crypto SRO do? Provide and enforce best practices, share knowledge, and boost the industry as a whole, to the benefit of its members and Canadians.

July 16th, 2020

Analysing Corporate Groups Through IP Filings: Me To We & The We Charity

My work often involves foreign companies that have unclear ownership structures that my clients would like to know more about. Given the ongoing scandal involving the We Charity, what can be learned by applying the same approach? What companies make up the We Charity and its related corporations? First the answer, then the method.

The Likely We Entities: 13 Corporations in Canada and the US

July 7th, 2020

COVID-19: We Should Not Impose Fines & Penalties During A Public Health Emergency

A senior lawyer I know recently posted on LinkedIn that they think people who don't wear masks should be charged with assault or maybe even "attempted murder". This wasn't a satirical post. My city councillor in Toronto, and all of the other city councillors, recently voted unanimously to bring in a penalty of at least $750 for not wearing a mask in a store, hotel elevator, church, and many other places in Toronto. That's approximately equal to one month of welfare payments in Ontario. This is not right, and I'm taking a break from my usual content about technology law to help bring a different perspective to this issue that I think has gone unnoticed in the panic over a virus that has killed hundreds of thousands of people worldwide.

People are scared and people have died. There's no understating the severity of this, but I'm thankful that the worst predictions of the pandemic haven't come true.

March 24th, 2020

CFTC Releases Guidance on Digital Asset Delivery

The CFTC has released their final interpretative guidance on what counts as "actual delivery" for digital assets. The Commodity Future Trading Commission (CFTC) is the primary American regulator of derivatives. They are the lesser known counterpart to the US Securities Exchange Commission (SEC).

This is related to the Canadian Securities Adminitrator's guidance a few months ago about "immediate delivery" of digital assets within Canadian securities laws (and footnote 114 refers to it directly). I expect that the CFTC's view will be influential on Canadian regulators.

February 11th, 2020

Canada Stablecorp Launches Canadian Dollar Stablecoin: QCAD

Today was the launch of Canada Stablecorp's "QCAD" product, a Canadian Dollar stablecoin available on the Ethereum network. The launch was covered by Coindesk and the press release is live here. There's also a short FAQ at stablecorp.ca/faqs.

A few of the launch partners put out their own news/press releases, such as Bitvo and Netcoins. The news was also carried by Yahoo Finance and other outlets today.

February 10th, 2020

Key Laws for Canadian Cryptocurrency Companies in 2020

I've been blogging about legal issues for Canada's cryptocurrency/blockchain industry since 2013. In that time, there's been a transition from a focus on payments/commercial issues to areas that are more commonly seen by large enterprises like securities law, sanctions, and Excise Tax Act issues. Below are a few sareas that most frequently come up today with crypto companies, along with the sorts of questions that people have about them.

Key Areas of Canadian Law

January 21st, 2020

Have Canadian Securities Regulators Gone Too Far In Quest To Address Cryptocurrency Exchange Risks?

The Canadian Securities Administrators (the joint body of Canada's provincial securities regulators) issued guidance on January 16th, 2020 that explains their thinking: the way that nearly all cryptocurrency exchanges operate around the world is in contravention of Canadian securities laws. The interpretation necessary to get there is inconsistent with other jurisdictions and poses risks to the Canadian digital economy outside of the cryptocurrency sphere.

This blog post explains what the latest guidance is, why industry players are concerned, and why it's problematic for the future. This is a very long blog post because of the complexity of this issue. Here's a brief table of contents:

January 6th, 2020

Could Blockchain Be The Next Gambling For Canada's First Nations?

In the late 1990s the Mohawaks of Kahnawake, near Montreal, opened Canada's first data centre located on First Nations territory and enacted their own regulation for online gambling. Their online gambling regime is administered by the Kahnawake Gambling Commission and it has issued dozens of gambling licenses that are used by hundreds of online gambling websites. Although gambling has likely not been a huge moneymaker for the Kahnawake territory, it has paved a path over the last twenty years that is a useful case study for innovative territorial leaders. What might be the next digital business opportunity for First Nations?

Learning From the Online Gambling Example

November 12th, 2019

Recent Developments in Canadian Blockchain Law: November, 2019

This article is a round-up of recent developments in Canadian blockchain law:

- A novel Bitcoin investment fund ("The Bitcoin Fund") put forward by 3iQ Corp. was approved by the OSC

- Upcoming changes to the Excise Tax Act to clarify virtual currency sales tax treatment

- Changes to take effect next summer regarding virtual currency dealers (PCMLTFA)

- Ontario Securities Commission makes clear that "I didn't know it was wrong" won't be accepted going forward

- OSC Launchpad approves the "FreedomX" secondary market trading platform by the TokenFunder team

- BC regulation prohibits sellers of "pill presses" from accepting virtual currency

Each of the above developments are explained below with links to the decisions/laws.

October 18th, 2019

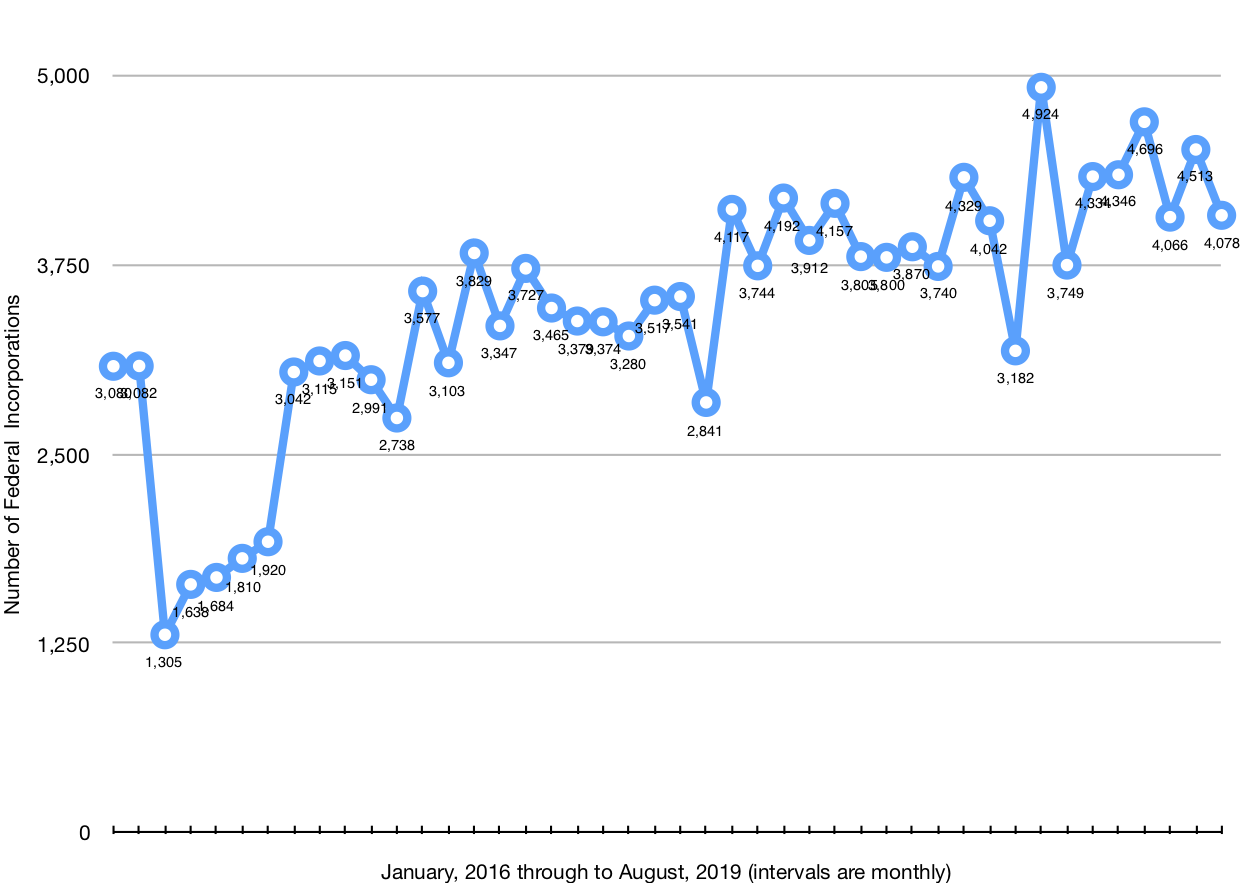

Federal Incorporations Are Mostly in Ontario and Increasing Rapidly

Over the last three years there's been a noticeable increaese in the number of Federal for-profit incorporations (CBCA). The graph above shows the increase in incorporations since January of 2016. This data is based on an analysis of over 150,000 Federal incorporations, indexed using the "Monthly Transactions" published by Corporations Canada (e.g. August 2019). The reports were aggregated, parsed, and then merged to create the above chart.

August 17th, 2019

Disruption is Coming to Retail Law

Retail law needs to be disrupted. We need new approaches to law, not just more of the same with a new label, or a tweak at the margins. What might this look like? One future product: instant, on-demand legal advice at 1/3 the price delivered through an app.

August 16th, 2019

SAFT Holder Rights: Rescission and Liability

SAFTs (explained below) are a type of legal agreement for the sale of digital “tokens” that originated in the USA in 2017. The fallout from the use of SAFTs is now starting to be seen in regulatory actions. This post explains the under-appreciated opportunity for civil actions by affected investors.

Many people bought into token projects in 2017-2018 using SAFTs and have suffered large losses. In some cases the investors may be able to recover their money through civil actions against the offerors, either in parallel or following up on, government efforts. This is a path to recovery that's received much less notice within cryptocurrency efforts than the high-profile cases brought by securities regulators, such as the ongoing Kin litigation (which involves a SAFT too).

June 1st, 2019

Digital Law for a Digital World, Creating a Better Legal System in Canada

We need a new system of law publishing in Canada: Digital Law

. Digital Law is a change in the way laws are made available to the public, not a change in the structure of our legal system or the entities that create the law.

May 13th, 2019

Why Is Legal Advice So Expensive in Ontario?

This article isn't about blockchain law (my day-to-day work and usual subject of this blog). It's about a much bigger issue.

May 10th, 2019

Large-Scale Money Laundering Is Old-Fashioned, Not Done Using Cryptocurrency

In BC, an expert panel commissioned by the provincial government has estimated that $5.3 billion/year is laundered through real estate transactions (pg. 54): https://news.gov.bc.ca/files/Combatting_Money_Laundering_Report.pdf. Even if every single cryptocurrency trade in Canada was done by criminals for the purpose of money laundering, it wouldn't come close to the scale of money laundering in BC, in one year, using real estate.

For years now I've been on panels where people bring up money laundering using cryptocurrency (always without evidence). To the extent that anyone took this idea seriously, they've apparently been looking in the wrong place. I hope that this new research about money laundering helps refocus Canadian regulators' attention on the boring, old-fashioned reality of financial crimes in Canada, and around the world.

May 4th, 2019

What Wasn't Said In The CSA-IIROC Consultation for Crypto Asset Platforms: Analysing Assumptions

On March 14th of this year, the Canadian Securities Administrators and a national non-profit funded by investment industry dealers and marketplaces, IIROC, put out a consultation paper for the regulation of crypto asset marketplaces. The paper is titled "Consultation Paper 21-402: Proposed Framework for Crypto-Asset Trading Platforms" and it asks 22 questions about how the industry should be regulated. Many people have written about this and will be submitting comments to the CSA, but this blog post looks at what assumptions exist in the consultation itself. I will leave answering the questions posed by the consultation to other smart people in the field who are working on this.

This is a complicated topic that deserves a much more comprehensive discussion, but I hope that this article about assumptions will help others who are responding to the CSA/IIROC before the May 15th deadline.

April 29th, 2019

Toronto Blockchain Week 2019: Synopsis

Toronto Blockchain Week was a huge success last week. We managed to rally our vibrant, diverse community of educators, businesspeople, developers, government, and the public, to attend 47 different events across Toronto. Thousands of people attended the week's events, and I was impressed by the calibre of the events I attended (unfortunately there were so many that I only attended about a third of them). Here are just a few of the organizations that ran/helped run events last week:

March 26th, 2019

Creative Destruction Lab's Blockchain Incubator: Starts July 22nd

The Creative Destruction Lab, located at U of T's Rotman School of Management, has launched a blockchain-focused incubator program. The program offers mentorship and (up to) $100k USD of investment, in exchange for an equity stake.

March 17th, 2019

3iQ Bitcoin Fund Proposal Denied By OSC, Application Filed For Hearing

The Ontario Securities Commission (OSC) released its decision to refuse to issue a receipt for a proposed NRIF (see below) investment product called "The Bitcoin Fund" last month. The fund is being put forward by the tenacious team at 3iQ Corp., who on Friday filed an application requesting a hearing about the refusal. The application contains further details about their plans, including the role of Gemini Trust Company, a US trust company, that they intend to act as a sub-custodian to Cidel Trust Company, a Canadian trust company.

3iQ has been trying to establish this fund in Canada since at least 2016 (according to their application). For anyone interested in following in their footsteps, their 26 page filing is required reading. The investment managers (and their lawyers) have put a lot of thought into these issues, and they've included operational details in the application that are interesting notes about the state of the industry in Q1 2019. For example, paragraphs 38-49 discuss their proposed Bitcoin valuation methodology and why, in their view, it conforms to NI 81-106.