Last Friday I spoke at the inaugral professional development event of the new Metaverse Bar Association. Below are my remarks adapted from that event, aimed at lawyers trying to become advisors to token projects.

Last Friday I spoke at the inaugral professional development event of the new Metaverse Bar Association. Below are my remarks adapted from that event, aimed at lawyers trying to become advisors to token projects.

Seinfeld said that he became a good comedian by writing jokes every day. He marked off each day on a calendar and made sure to do it every day, without exceptions. If there's one key to becoming good at something it's to keep doing it every day.

Try to do one useful thing a day. This maxim works as a lawyer or in any other field.

Lawyers often regard their job as being completed once they've finished writing up a contract. On the other hand, lawyers often have to deal with signing mistakes and errors that are made in making use of contracts. Docusign, and similar software, solves some of this problem but there's so much more that could be done.

Many lawyers and businesses have been discussing the idea of ChatGPT and similar LLMs taking over their work. There's a lot of promise about revolutionizing the way people work. But in reality, these tools are a very long away from replacing humans. The reason for this is that they're not good at law, they fail to properly understand questions, they fail to identify gaps in the facts that require follow up questions, and they're susceptible to making up law that doesn't exist. Below are a few examples that illustrate these problems.

This is part three of a three part series. Part one explored the business side of various crypto lenders that have gone bankrupt, and part two looked at the legal side of these companies' pre-bankruptcy operations (which reached many billions of dollars of claims). This third part looks at the CSA Staff Notice that mentions these companies and proposes new restrictions on Canadian cryptocurrency trading platforms: CSA Staff Notice 21-332 (CSAN 21-332).

For the reader who is new to these sorts of staff notices: they are a way for securities regulators to public their internal thinking about an issue. Although theoretically not law, these staff notices are often treated by practitioners as if they are law, and they're an important part of the regulatory landscape in Canada. CSAN 21-332 is complicated. This blog post looks only at the parts of the notice that are related to credit/borrowing.

The first part of this series examined the crypto lenders that took the blockchain world by storm a few years ago, and ended in several high-profile bankruptcies. This post looks at what the laws about lending are, and the arguments for why these crypto lenders weren't violating laws (despite the SEC & state-level settlements that say they were). This post completes the necessary background to understand the next part in this series, which is about the government's response in Canada to the failures of crypto lenders in the US. The first half of this article explains the background on various sorts of credit products, and then the second half gets into the specifics of the legal arguments of the now-bankrupt crypto lenders.

The image above is from section 48 of Hammurabi's Code and it concerns the delay of payment of debt due to crop failure. The Canadian Securities Administrators (CSA) issued their own document concerning debt, around 3700 years after Hammurabi. A lot has changed in the intervening years, but not the government's interest in regulating debt and credit. This blog post is a part of a series that looks at that interest in the context of the cryptocurrency industry, with particular attention to the companies mentioned in the CSA's most recent guidance document: Voyager Digital, Celsius, BlockFi and Genesis. These companies, up until they went broke, managed billions of dollars of other people's money, and promised a new world of credit for crypto. What went wrong? What were they doing? Why have regulators taken such a strong interest? Read on to learn more about what was once a popular business model.

As economies develop and markets improve, it's natural to see the distinction between money and asset grow thinner. Bitcoin and money is a good example of this. Money market funds and bank deposit accounts is another. As transaction costs decrease, people can switch between assets in a way that's very money-like.

The thinning line between asset and money has legal practice ramifications because the blurring of categories calls for greater care in ensuring that businesses stay on the right side of laws written for a world in which the lines were thicker and more obvious.

Electronic contracts are lawful, binding, and a constant presence in our lives. At one point, contracts required “wet ink” signatures, or special stamps, or other formalities. In the modern era (or at least, in modern countries), these formalities are dispensed with in favour of ease of doing business. In Ontario, some of these rules are formalized through 23 year old legislation: the Electronic Commerce Act, 2000. Similar laws exist elsewhere to enable online business. And yet, too many people are still signing agreements. Sometimes they sign them using Docusign or similar tools, where they're electronically mimicking the wet ink signature that's not needed. Lawyers sometimes encourage this, often because of a cultural belief in formality that might make people feel better about the whole thing. We can do better.

The tallest trees are a random pattern of branches. Trees grow where the sunlight is, where the wind pulls them, and a thousand other factors that cause the random pattern of branches. This is a better pattern for life than a regimented tree where the branches all grow exactly in the same fashion, or in the same straight lines. The most efficient, and most productive, form is a mess of branches. Startups are the same. There's order in the chaos, and the results are better. But there's also a general form to trees, although they come in different kinds, and the skill is in navigating within these parameters.

ChatGPT can do quite a good job of generating routine documents. It is very good at generating SaaS legal agreements that look like the many boilerplate agreements scattered across the Internet. Below is an example prompt and the outputs from “ContractGPT”.

You can run this example yourself by signing up for a ChatGPT account with OpenAI. There have been many startups that have done this sort of work in the past, but they will be quickly eclipsed by the power of large language models like GPT4 (already available to some people).

I've been working in the blockchain space since before Ethereum started. Working on Ethereum itself was my first experience with watching an integrated team of lawyers and professionals at work, rapidly bringing forth a brand new technology product. That work began my exposure to working in interdisciplinary teams with many (much more) experienced lawyers. Even nearly ten years later, I'm rarely the most knowledgeable lawyer in the room for every issue. And that's what clients want. Teams of specialists are required for sophisticated businesses, but there also needs to be a tech-savvy lawyer at the centre of specialty counsel.

Lawyers often imagine that clients want them to be some sort of legal titan, reciting statutory excerpts and explaining dicta. There's a place for those lawyers, but what most companies need is product counsel.

We have within us the ability to generalize from a few bad examples. The ancient humans who didn't watch out for snakes or learn from someone else drowning are the ones who didn't survive. But this same instinct can cause people to over-generalize from disasters to see them around every corner. Whether that's exchange failures like FTX, Canada's own QuadrigaCX, or the many scams and disasters catalogued on web3isgoinggreat.com, it's easy to think that the crypto space is one big disaster. Many people hold this sentiment, and it's understandable. It's easy to take these disasters and translate them into the idea that the cryptocurrency space is opposed to the rule of law. I don't think that's correct.

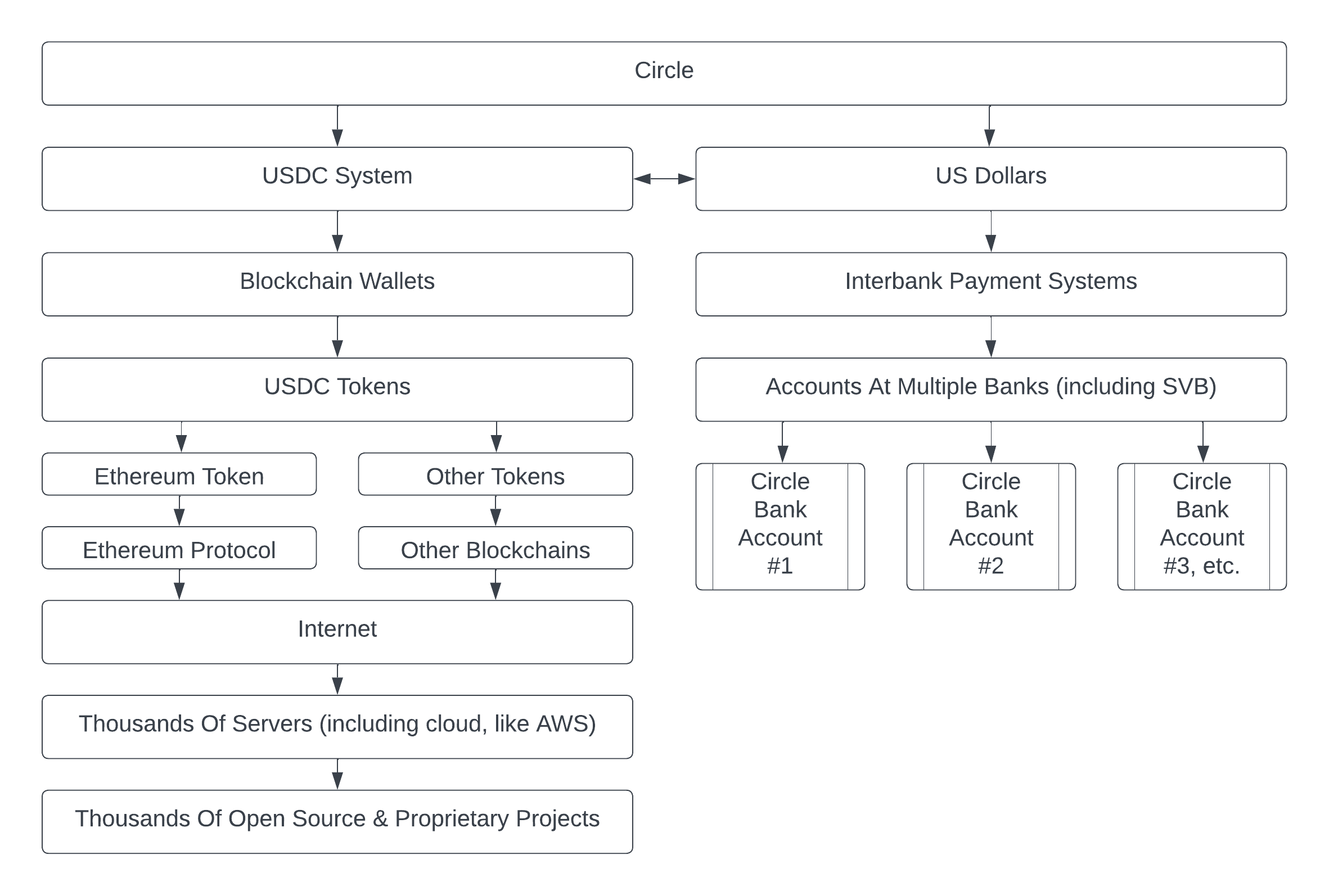

Silicon Valley Bank (SVB) failed on Friday. With around $200 billion in assets, this is one of the largest bank failures in US history. It has particularly affected the cryptocurrency space because SVB was especially concentrated in the technology sector. At least one major stablecoin used SVB to hold a portion of their cash: USDC. Circle Internet Financial, the corporate group behind USDC, announced that $3.3 billion USD is stuck in SVB, which is currently under the control of the FDIC (US federal government).

Canada needs to get serious about fighting financial crimes. Frauds and scams cost Canadians billions of dollars a year and undermine their faith in legitimate businesses. Fraud reports keep increasing, while police clearance rates are falling (in absolute terms, and relative terms). I get many calls from people who are the victims of sophisticated criminals and I've heard their stories. Lawyers can't usually do much to help people. The police themselves are under-resourced and don't have the necessary technical resources to combat sophisticated criminals, who target Canadians from abroad.

A specialty police unit is the best means of targetting frauds. It's better in most cases than using securities regulators, consumer protection regulators, or other agencies that don't have the necessary experience and skills to take on modern criminals. The days of pickpockets are over. Canadians don't lose the $200 in their wallet. They lose their $500,000 retirement nest egg. The costs are staggering.

Bahamas-based FTX closed (spectacularly) last year, taking with it $95 million USD of investment from the Ontario Teachers' Pension Plan (OTPP), and billions of dollars of customer assets. FTX was not registered in Canada, but it was in the process of acquiring Canadian crypto dealer Bitvo, which news reports indicate was held up by pending regulatory approval. It also seems that there are reports that FTX was serving at least some Canadians but that part of their operation was murky. At some point, Ontarians were onboarded and trading on FTX, then later refused (perhaps due to action by the OSC behind the scenes - this is not explained publicly).

It's a new year and a new run up in cryptocurrrency prices. These moments always trigger media speculation and end the "is crypto dead?" questions that immediately crop up when prices go down. The end of 2022 saw the failure of several large non-Canadian businesses in the cryptocurrency space, fueling concerns like "is crypto dead?" and whether "crypto will ever recover". I've been seeing these waves of questions and concerns, and then the euphoria when prices go in the other direction, for nearly a decade. The truth is that cryptocurrency prices are volatile, and that cryptocurrency has never died. Even sustained downward prices aren't a sign of failure or "the end of crypto". Because cryptocurrencies were not invented to go up in price and they function just fine without large speculative bubbles.

Cryptocurrency started off as a simple, if technologically complex, payment system. The basic idea is that public/private key cryptography is used to ensure that one number decrements and the other increments. These numbers are now worth billions and have spawned many new applications. The progress is amazing but the downside of a system in which numbers are sent from one place to another is that they can be traced. But more than just being traced, they can be seen and traced by anyone, at any time, for the rest of time. This is an uncommon pattern for money-related tools and not always a good thing.

OpenAI's DALL-E model for generating images was made available a few months ago. One of its uses is to generate art, and it's already being used by magazines and blogs to supply images for articles. I tried it out for supplying images for articles on my own blog. The results are funny, but not useful.

The Ontario Securities Commission (OSC) put out a report on their survey of cryptocurrency use a few days ago. The survey shows that 13% of Cannadians own cryptocurrency (or cryptocurrency-based securities such as ETFs), Canadians have made huge gains on crypto (pg. 20 of the survey), and a quarter of trading platform users make use of VPNs.

The OSC concluded that their survey shows Canadians aren't knowledgeable about crypto, but if anything the survey shows that they need to carefully think about terms and definitions. Cryptocurrency is hard to understand but the questions posed to test the public's knowledge say more about the OSC than about Canadians.