Here are seven trends happening in the world of blockchain that may affect Canadian and American regulation in the coming years: on-chain insurance, prediction markets, decentralized exchanges, collectibles, digital dollars, securitization and leverage.

#1 On-chain Insurance

At the end of last year the French insurance giant AXA (~$100 billion EUR in 2019 revenue) shuttered a little noticed division that created a flight cancellation insurance product called "Fizzy". Fizzy ran on the Ethereum blockchain and had customers but failed to meet "commercial targets". A victim of being too early to market? This product should be a wake up call to insurers who think that blockchain products won't create the same sort of global competition created by Uber taking on taxi companies. Whether the challenge comes from international giants like AXA in France or a tiny startup based in Hyderabad, I expect this will eventually have ramifications on the regulation of insurance.

#2 Prediction Markets

It's a short jump from insurance to gambling, and in particular the area known as "prediction markets", pioneered by a now defunct Irish company called Intrade. The cryptocurrency version of this is projects like Augur that permit on-chain betting on events. Although there's a regulatory difference, technologically-speaking these platforms can look a lot like derivatives markets (and may even offer trading in derivatives). They are cheaper, more understandable (where there's open source code), globally accessible, and difficult to shut down. Governments may react by loosening restrictions on gambling.

#3 Decentralized Exchanges

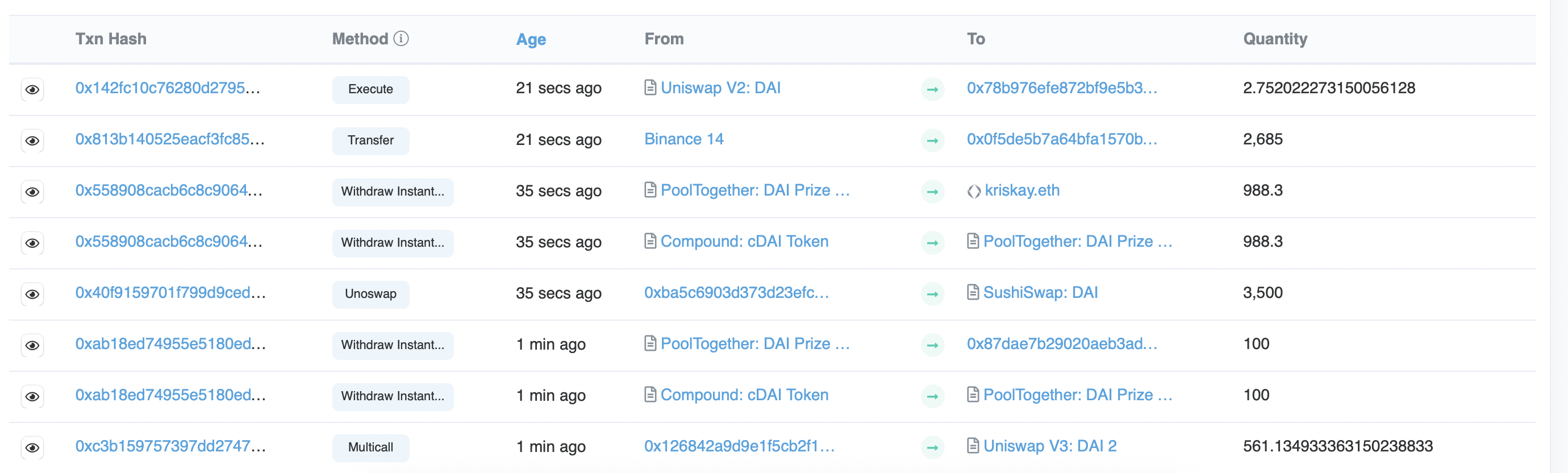

Uniswap is a decentralized exchange ("DEX") that has upended cryptocurrency trading by bring the model created by Bancor to a wider audience. Uniswap is now being used for tens or hundreds of millions of dollars a day worth of cryptocurrency trades using "liquidity pools" instead of an order book. Uniswap's success has spawned new interest in creating on-chain trading systems that can be used for a wide variety of assets. Although not useful for fiat movements, these platforms intersect with other trends like digital dollars (see below) that many people think is the future of other kinds of trading. These sorts of services also challenge the MSB regulatory system as they are unregistered with AML authorities, resting on the (debatable) legal theory that they are decentralized.

#4 Collectibles

The Canadian developer of 2017's Ethereum-based "CryptoKitties" collectibles has launched a new blockchain named Flow

and a new NBA-licensed collectible system called NBA Top Shot. NBA Top Shot is a very well-produced multimedia collectibles game that's a new twist on collectible cards. Many people laughed at the idea of CryptoKitties three years ago but the NBA does their homework before striking licensing deals. These sorts of collectibles may prompt Canadian authorities to give further consideration to the loot box

model used by many video games, and further elaborate on the borders between competing areas of law like gambling, consumer protection, securities, etc.

#5 Digital Dollars

Central Bank Digital Currencies ("CBDC") have been a hot topic for central banks and the wider payment systems that may be using their new versions of money. This term has been used liberally by central banks and sometimes means no innovation at all and other times means radical change. Many of them are modelled on the successes of private-sector digital dollar solutions ("stablecoins") like USDC for the US dollar. A Canadian client of mine operates QCAD for Canadian dollars, and they are one of hundreds of different national stablecoins that have launched over the years following the success of early pioneer USDT. Stablecoins can be expected to make a significant impact on the global payments/money regulatory system in the coming years (whether public, private, or both).

#6 Securitization

Ethereum will soon be traded in securitized form in Canada through 3iQ's "Ether Fund", which follows the success of their earlier Bitcoin Fund. These securitized cryptocurrency products (some eligible for registered accounts) are being launched all over the world and have seen enormous inflows of money. In the United States these products have attracted over $10 billion, and as they become more popular will likely have an impact on securities regulation. 3iQ's protracted legal campaign to get the Bitcoin Fund launched in Canada shows the reluctance of Canadian regulators about these products, but their success may change some minds in the government who may be looking for post-COVID growth industries. Canada is well-placed to become a global leader in this field, but it wouldn't be surprising to see a much larger global asset manager buy out 3iQ or other Canadian pioneers as they prove the model.

#7 Leverage

Algorithmic stablecoins like MakerDAO are often used to create leverage for cryptocurrency speculation, and the creation of "flash loans" this year will likely accelerate the trend of on-chain leverage. Flash loans through Aave and DyDx plu longer term leverage through algorithmic stablecoins, in combination with some of the trends listed above, may be a powerful agent for change. Securities regulators typically try to control/minimize leverage, but traders/gamblers are looking for big bets. As the regulatory boundaries start to blur into each other because of technological change, I expect to see more leverage in more places.

Conclusion

Whether it's collectibles, leverage, CBDCs, insurance, or DEXs, or a combination of them, the rapid pace of development in blockchain-based products is sure to cause regulatory shifts in 2021. The Bank of Canada hired several staff people in the summer to work on their CBDC project, and few people who've been through 2020 can say they expect technological development to slow in 2021. How consumers, businesses, and regulators will react is much less predictable, but regulatory change is a good bet.