Electronic contracts are lawful, binding, and a constant presence in our lives. At one point, contracts required “wet ink” signatures, or special stamps, or other formalities. In the modern era (or at least, in modern countries), these formalities are dispensed with in favour of ease of doing business. In Ontario, some of these rules are formalized through 23 year old legislation: the Electronic Commerce Act, 2000. Similar laws exist elsewhere to enable online business. And yet, too many people are still signing agreements. Sometimes they sign them using Docusign or similar tools, where they're electronically mimicking the wet ink signature that's not needed. Lawyers sometimes encourage this, often because of a cultural belief in formality that might make people feel better about the whole thing. We can do better.

Addison Cameron-Huff, Blockchain Lawyer

Thoughts and opinions of a Toronto-based cryptocurrency lawyer who's worked in the industry since 2014.

Follow @aCameronhuffMarch 30th, 2023

Tall Trees And Startups

The tallest trees are a random pattern of branches. Trees grow where the sunlight is, where the wind pulls them, and a thousand other factors that cause the random pattern of branches. This is a better pattern for life than a regimented tree where the branches all grow exactly in the same fashion, or in the same straight lines. The most efficient, and most productive, form is a mess of branches. Startups are the same. There's order in the chaos, and the results are better. But there's also a general form to trees, although they come in different kinds, and the skill is in navigating within these parameters.

March 27th, 2023

ContractGPT

ChatGPT can do quite a good job of generating routine documents. It is very good at generating SaaS legal agreements that look like the many boilerplate agreements scattered across the Internet. Below is an example prompt and the outputs from “ContractGPT”.

You can run this example yourself by signing up for a ChatGPT account with OpenAI. There have been many startups that have done this sort of work in the past, but they will be quickly eclipsed by the power of large language models like GPT4 (already available to some people).

March 13th, 2023

The Product Counsel Role in Blockchain Projects

I've been working in the blockchain space since before Ethereum started. Working on Ethereum itself was my first experience with watching an integrated team of lawyers and professionals at work, rapidly bringing forth a brand new technology product. That work began my exposure to working in interdisciplinary teams with many (much more) experienced lawyers. Even nearly ten years later, I'm rarely the most knowledgeable lawyer in the room for every issue. And that's what clients want. Teams of specialists are required for sophisticated businesses, but there also needs to be a tech-savvy lawyer at the centre of specialty counsel.

Lawyers often imagine that clients want them to be some sort of legal titan, reciting statutory excerpts and explaining dicta. There's a place for those lawyers, but what most companies need is product counsel.

March 12th, 2023

Rule Of Law And Cryptocurrency

We have within us the ability to generalize from a few bad examples. The ancient humans who didn't watch out for snakes or learn from someone else drowning are the ones who didn't survive. But this same instinct can cause people to over-generalize from disasters to see them around every corner. Whether that's exchange failures like FTX, Canada's own QuadrigaCX, or the many scams and disasters catalogued on web3isgoinggreat.com, it's easy to think that the crypto space is one big disaster. Many people hold this sentiment, and it's understandable. It's easy to take these disasters and translate them into the idea that the cryptocurrency space is opposed to the rule of law. I don't think that's correct.

Rule Of Law

March 12th, 2023

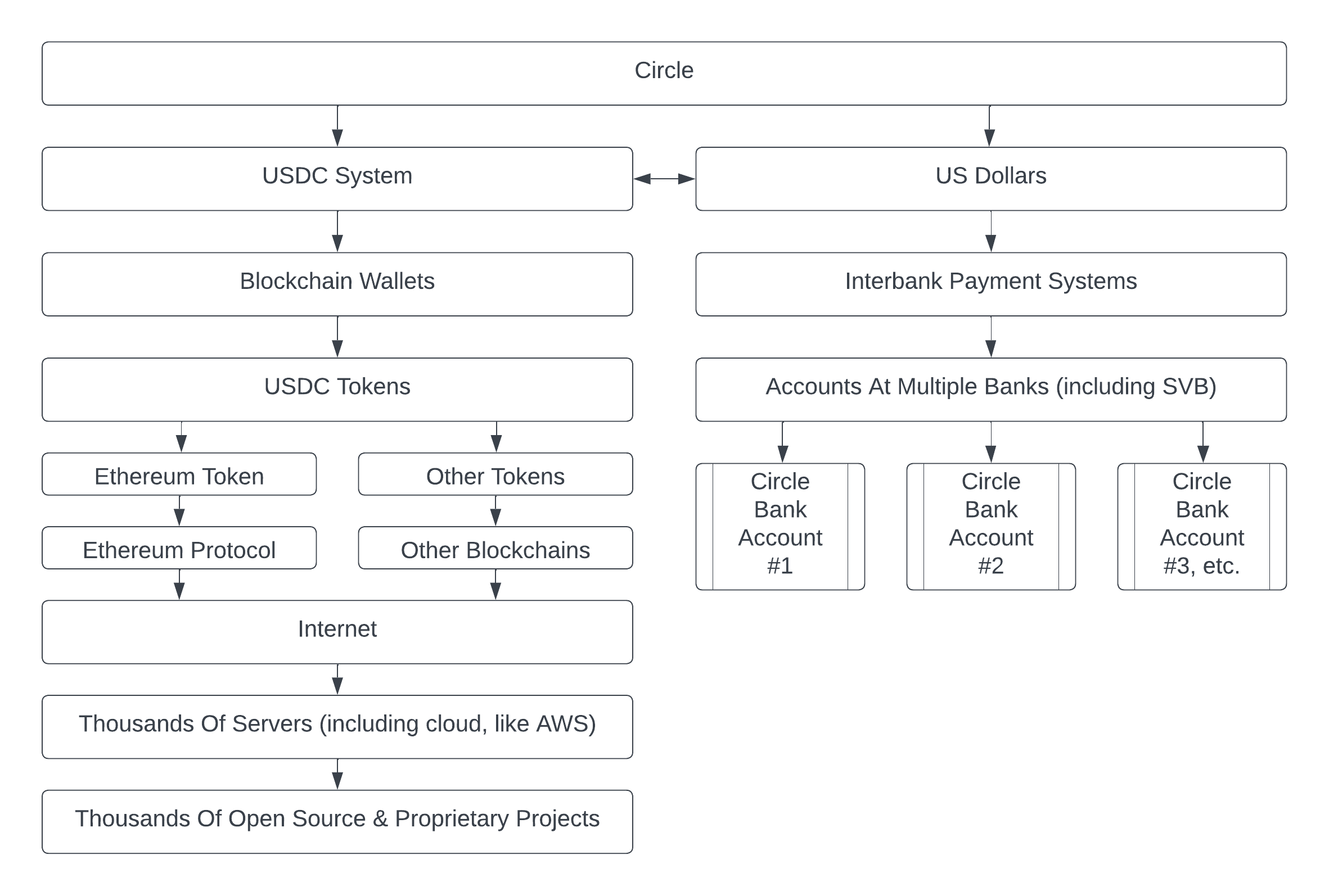

USDC and Silicon Valley Bank

Silicon Valley Bank (SVB) failed on Friday. With around $200 billion in assets, this is one of the largest bank failures in US history. It has particularly affected the cryptocurrency space because SVB was especially concentrated in the technology sector. At least one major stablecoin used SVB to hold a portion of their cash: USDC. Circle Internet Financial, the corporate group behind USDC, announced that $3.3 billion USD is stuck in SVB, which is currently under the control of the FDIC (US federal government).

March 12th, 2023

The Need For Increased Financial Policing In Canada

Canada needs to get serious about fighting financial crimes. Frauds and scams cost Canadians billions of dollars a year and undermine their faith in legitimate businesses. Fraud reports keep increasing, while police clearance rates are falling (in absolute terms, and relative terms). I get many calls from people who are the victims of sophisticated criminals and I've heard their stories. Lawyers can't usually do much to help people. The police themselves are under-resourced and don't have the necessary technical resources to combat sophisticated criminals, who target Canadians from abroad.

A specialty police unit is the best means of targetting frauds. It's better in most cases than using securities regulators, consumer protection regulators, or other agencies that don't have the necessary experience and skills to take on modern criminals. The days of pickpockets are over. Canadians don't lose the $200 in their wallet. They lose their $500,000 retirement nest egg. The costs are staggering.

March 12th, 2023

Japan, Canada, and FTX: Crypto Dealer Safety

Bahamas-based FTX closed (spectacularly) last year, taking with it $95 million USD of investment from the Ontario Teachers' Pension Plan (OTPP), and billions of dollars of customer assets. FTX was not registered in Canada, but it was in the process of acquiring Canadian crypto dealer Bitvo, which news reports indicate was held up by pending regulatory approval. It also seems that there are reports that FTX was serving at least some Canadians but that part of their operation was murky. At some point, Ontarians were onboarded and trading on FTX, then later refused (perhaps due to action by the OSC behind the scenes - this is not explained publicly).

The Canadian Regulatory Regime

January 17th, 2023

Cryptocurrency: Overlapping Use Cases

It's a new year and a new run up in cryptocurrrency prices. These moments always trigger media speculation and end the "is crypto dead?" questions that immediately crop up when prices go down. The end of 2022 saw the failure of several large non-Canadian businesses in the cryptocurrency space, fueling concerns like "is crypto dead?" and whether "crypto will ever recover". I've been seeing these waves of questions and concerns, and then the euphoria when prices go in the other direction, for nearly a decade. The truth is that cryptocurrency prices are volatile, and that cryptocurrency has never died. Even sustained downward prices aren't a sign of failure or "the end of crypto". Because cryptocurrencies were not invented to go up in price and they function just fine without large speculative bubbles.

Speculation/Gambling/Investing

October 24th, 2022

The Evolution Of Cryptocurrency Traceability: The Need For Curtains And Doors

Cryptocurrency started off as a simple, if technologically complex, payment system. The basic idea is that public/private key cryptography is used to ensure that one number decrements and the other increments. These numbers are now worth billions and have spawned many new applications. The progress is amazing but the downside of a system in which numbers are sent from one place to another is that they can be traced. But more than just being traced, they can be seen and traced by anyone, at any time, for the rest of time. This is an uncommon pattern for money-related tools and not always a good thing.

October 23rd, 2022

OpenAI's DALL-E: Not Quite Ready For This Blog Yet

OpenAI's DALL-E model for generating images was made available a few months ago. One of its uses is to generate art, and it's already being used by magazines and blogs to supply images for articles. I tried it out for supplying images for articles on my own blog. The results are funny, but not useful.

October 23rd, 2022

The OSC Surveys Crypto Users And Tests Their Knowledge

The Ontario Securities Commission (OSC) put out a report on their survey of cryptocurrency use a few days ago. The survey shows that 13% of Cannadians own cryptocurrency (or cryptocurrency-based securities such as ETFs), Canadians have made huge gains on crypto (pg. 20 of the survey), and a quarter of trading platform users make use of VPNs.

The OSC concluded that their survey shows Canadians aren't knowledgeable about crypto, but if anything the survey shows that they need to carefully think about terms and definitions. Cryptocurrency is hard to understand but the questions posed to test the public's knowledge say more about the OSC than about Canadians.

October 18th, 2022

Automating Canadian Sanctions: An Example Program

Canada has a variety of active sanctions programs that aim to cut off the flow of money to foreign officials and companies. Most of these are executed as regulations under the Special Economic Measures Act. Less commonly, they're regulationed under the United Nations Act (implementing general UN sanctions) or, even less commonly, the Justice for Victims of Corrupt Foreign Officials Act. There can also be sanctions in other legal instruments. An overview of these programs is published by Global Affairs Canada.

October 16th, 2022

Growing Your Law Practice: My 100 Minute Audio Guide On The Business Of Law

I started my law practice directly after articling at a large Bay St. firm. I learned a lot about the profession at the highest levels, but not much about the business of law. Nearly a decade later I've picked up a few lessons that I wish I had known when I first started off. Below is my attempt at distilling some of this hard-earned experience into a program for how to grow and build a law practice. Click here to jump right to the content, or read on to learn more about this program.

About The Making Of This Program

October 8th, 2022

950 Canadian Law Firm Articles About Crypto

Canadian law firms have been heavily involved in the cryptocurrency space over the last few years. They've written tons of great articles, but they're difficult to find. So I've put them together, in the form of a unique list of 950 articles that mention "bitcoin", "ethereum", or "cryptoasset". The assembled pages are an interesting view on what's happening in Canadian law, and who's doing it (since many of the pages are lawyer profiles that mention their transactions).

October 7th, 2022

Recent Crypto Litigation in Canada

This blog post is an update on cryptocurrency litigation in Canada over the last 90 days. Although there's been a number of proceedings that mention "bitcoin" or "ether" on CanLII, there are really only four where the main subject matter was cryptocurrency.

The cases below concern a dispute over BTM management software, a self-represented person who ran a type of crypto investing club, a technical decision with respect to cryptocurrency ETFs, and exemptive relief granted to a well-known cryptocurrency dealer.

October 5th, 2022

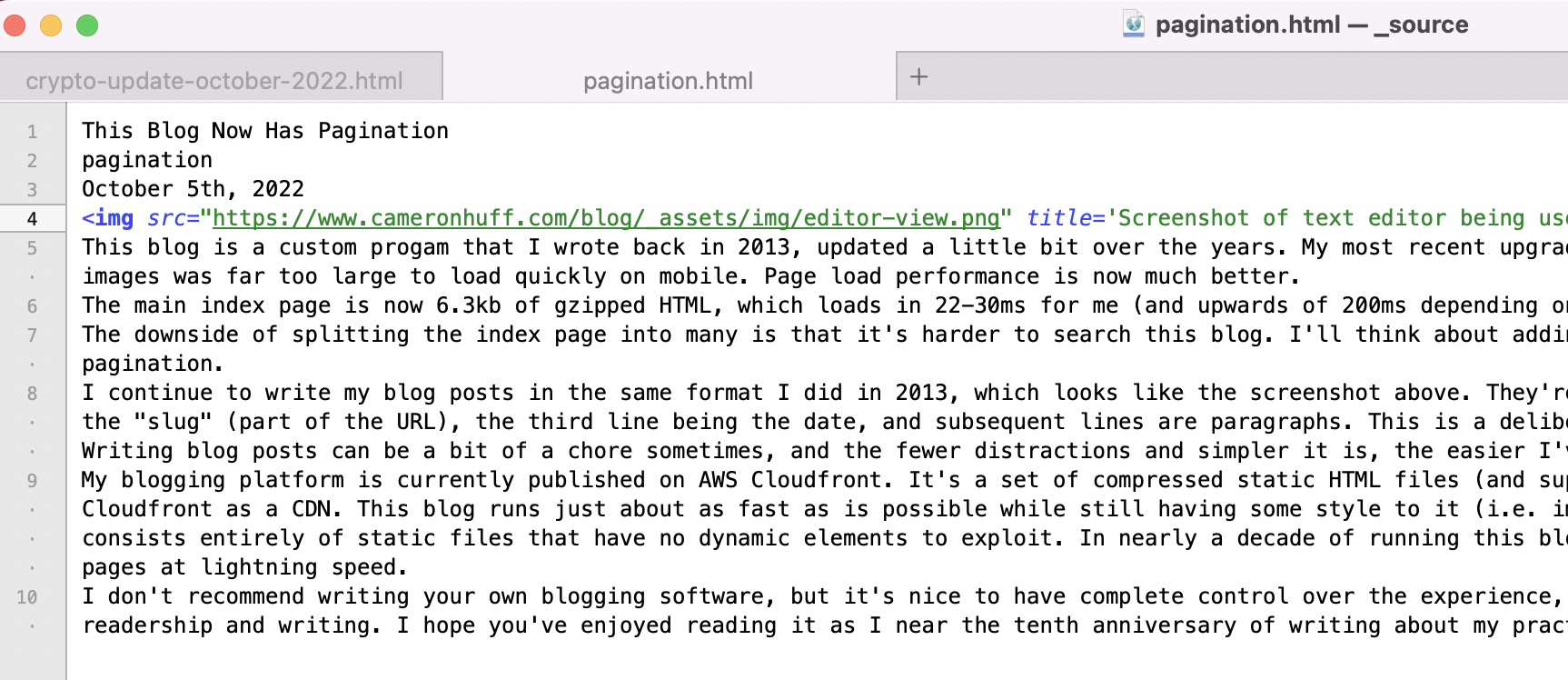

This Blog Now Has Pagination

This blog is a custom progam that I wrote back in 2013, updated a little bit over the years. My most recent upgrade is adding pagination, as the over 250 blog posts with high resolution images was far too large to load quickly on mobile. Page load performance is now much better.

October 5th, 2022

What's Happening In My Corner Of Cryptocurrency?

The first three quarters of the 2022 cryptocurrency industry have seen immense changes. In my own practice, the following developments have been top of mind: more useful NFTs, cryptocurrency litigation, large investments into platforms, politicians taking notice, proof of stake, and more.

The Rise Of Interesting NFTs

July 13th, 2022

LawGrow: An Audio Guide To Being A More Successful Lawyer

I've been a lawyer for eight years. Before that, I held many jobs, including website developer. This work has taught me a few things about how to connect with clients and grow a business. Today I'm launching a standalone website to share what I've learned in the form of concise 7-10 minute sessions as part of an audio guide on growing your law practice.

UPDATE: This is now free - I've posted all of the audio in a new blog post: https://www.cameronhuff.com/blog/grow-your-law-practice-audio-guide/.

June 12th, 2022

How To Choose Clients In The Cryptocurrency Field: 14 Tips

A couple days ago, a lawyer in the San Francisco area that I know wrote a blog post on why they stopped taking blockchain clients in 2017. Kyle Mitchell's blog post is noteworthy because it's written by a smart lawyer (who is also a programmer) who raises client management issues that are relevant to any lawyer who works in tech. These issues are even relevant to people who don't work as lawyers, because Kyle's thoughts are really about how to deal with aggressive businesspeople, some of whom may be breaching contracts or even breaking laws.

How, as a professional, can bad people - bad clients - be avoided? Kyle's answer is to cut off a field that he considers too risky. The rest of this blog post explains why I haven't followed in his footsteps. The end of this blog post contains some practical tips for lawyers to help avoid bad clients.