In the late 1990s the Mohawaks of Kahnawake, near Montreal, opened Canada's first data centre located on First Nations territory and enacted their own regulation for online gambling. Their online gambling regime is administered by the Kahnawake Gambling Commission and it has issued dozens of gambling licenses that are used by hundreds of online gambling websites. Although gambling has likely not been a huge moneymaker for the Kahnawake territory, it has paved a path over the last twenty years that is a useful case study for innovative territorial leaders. What might be the next digital business opportunity for First Nations?

Addison Cameron-Huff, Blockchain Lawyer

Thoughts and opinions of a Toronto-based cryptocurrency lawyer who's worked in the industry since 2014.

Follow @aCameronhuffJanuary 6th, 2020

Could Blockchain Be The Next Gambling For Canada's First Nations?

November 12th, 2019

Recent Developments in Canadian Blockchain Law: November, 2019

This article is a round-up of recent developments in Canadian blockchain law:

- A novel Bitcoin investment fund ("The Bitcoin Fund") put forward by 3iQ Corp. was approved by the OSC

- Upcoming changes to the Excise Tax Act to clarify virtual currency sales tax treatment

- Changes to take effect next summer regarding virtual currency dealers (PCMLTFA)

- Ontario Securities Commission makes clear that "I didn't know it was wrong" won't be accepted going forward

- OSC Launchpad approves the "FreedomX" secondary market trading platform by the TokenFunder team

- BC regulation prohibits sellers of "pill presses" from accepting virtual currency

Each of the above developments are explained below with links to the decisions/laws.

October 18th, 2019

Federal Incorporations Are Mostly in Ontario and Increasing Rapidly

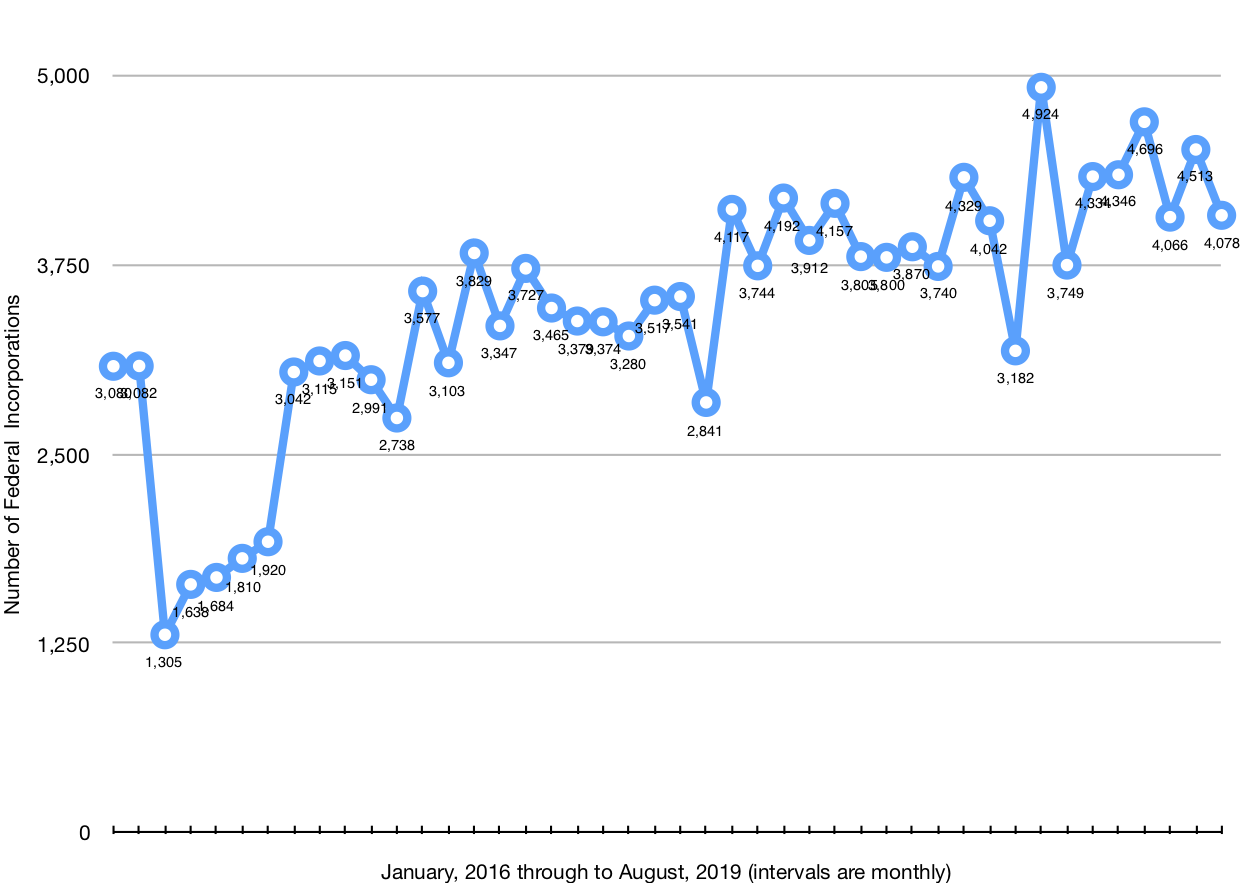

Over the last three years there's been a noticeable increaese in the number of Federal for-profit incorporations (CBCA). The graph above shows the increase in incorporations since January of 2016. This data is based on an analysis of over 150,000 Federal incorporations, indexed using the "Monthly Transactions" published by Corporations Canada (e.g. August 2019). The reports were aggregated, parsed, and then merged to create the above chart.

August 17th, 2019

Disruption is Coming to Retail Law

Retail law needs to be disrupted. We need new approaches to law, not just more of the same with a new label, or a tweak at the margins. What might this look like? One future product: instant, on-demand legal advice at 1/3 the price delivered through an app.

August 16th, 2019

SAFT Holder Rights: Rescission and Liability

SAFTs (explained below) are a type of legal agreement for the sale of digital “tokens” that originated in the USA in 2017. The fallout from the use of SAFTs is now starting to be seen in regulatory actions. This post explains the under-appreciated opportunity for civil actions by affected investors.

Many people bought into token projects in 2017-2018 using SAFTs and have suffered large losses. In some cases the investors may be able to recover their money through civil actions against the offerors, either in parallel or following up on, government efforts. This is a path to recovery that's received much less notice within cryptocurrency efforts than the high-profile cases brought by securities regulators, such as the ongoing Kin litigation (which involves a SAFT too).

June 1st, 2019

Digital Law for a Digital World, Creating a Better Legal System in Canada

We need a new system of law publishing in Canada: Digital Law

. Digital Law is a change in the way laws are made available to the public, not a change in the structure of our legal system or the entities that create the law.

May 13th, 2019

Why Is Legal Advice So Expensive in Ontario?

This article isn't about blockchain law (my day-to-day work and usual subject of this blog). It's about a much bigger issue.

May 10th, 2019

Large-Scale Money Laundering Is Old-Fashioned, Not Done Using Cryptocurrency

In BC, an expert panel commissioned by the provincial government has estimated that $5.3 billion/year is laundered through real estate transactions (pg. 54): https://news.gov.bc.ca/files/Combatting_Money_Laundering_Report.pdf. Even if every single cryptocurrency trade in Canada was done by criminals for the purpose of money laundering, it wouldn't come close to the scale of money laundering in BC, in one year, using real estate.

For years now I've been on panels where people bring up money laundering using cryptocurrency (always without evidence). To the extent that anyone took this idea seriously, they've apparently been looking in the wrong place. I hope that this new research about money laundering helps refocus Canadian regulators' attention on the boring, old-fashioned reality of financial crimes in Canada, and around the world.

May 4th, 2019

What Wasn't Said In The CSA-IIROC Consultation for Crypto Asset Platforms: Analysing Assumptions

On March 14th of this year, the Canadian Securities Administrators and a national non-profit funded by investment industry dealers and marketplaces, IIROC, put out a consultation paper for the regulation of crypto asset marketplaces. The paper is titled "Consultation Paper 21-402: Proposed Framework for Crypto-Asset Trading Platforms" and it asks 22 questions about how the industry should be regulated. Many people have written about this and will be submitting comments to the CSA, but this blog post looks at what assumptions exist in the consultation itself. I will leave answering the questions posed by the consultation to other smart people in the field who are working on this.

This is a complicated topic that deserves a much more comprehensive discussion, but I hope that this article about assumptions will help others who are responding to the CSA/IIROC before the May 15th deadline.

April 29th, 2019

Toronto Blockchain Week 2019: Synopsis

Toronto Blockchain Week was a huge success last week. We managed to rally our vibrant, diverse community of educators, businesspeople, developers, government, and the public, to attend 47 different events across Toronto. Thousands of people attended the week's events, and I was impressed by the calibre of the events I attended (unfortunately there were so many that I only attended about a third of them). Here are just a few of the organizations that ran/helped run events last week:

March 26th, 2019

Creative Destruction Lab's Blockchain Incubator: Starts July 22nd

The Creative Destruction Lab, located at U of T's Rotman School of Management, has launched a blockchain-focused incubator program. The program offers mentorship and (up to) $100k USD of investment, in exchange for an equity stake.

March 17th, 2019

3iQ Bitcoin Fund Proposal Denied By OSC, Application Filed For Hearing

The Ontario Securities Commission (OSC) released its decision to refuse to issue a receipt for a proposed NRIF (see below) investment product called "The Bitcoin Fund" last month. The fund is being put forward by the tenacious team at 3iQ Corp., who on Friday filed an application requesting a hearing about the refusal. The application contains further details about their plans, including the role of Gemini Trust Company, a US trust company, that they intend to act as a sub-custodian to Cidel Trust Company, a Canadian trust company.

3iQ has been trying to establish this fund in Canada since at least 2016 (according to their application). For anyone interested in following in their footsteps, their 26 page filing is required reading. The investment managers (and their lawyers) have put a lot of thought into these issues, and they've included operational details in the application that are interesting notes about the state of the industry in Q1 2019. For example, paragraphs 38-49 discuss their proposed Bitcoin valuation methodology and why, in their view, it conforms to NI 81-106.

March 11th, 2019

Business Idea: A Locally-Encrypted Legal Platform Like Clio

Legal platforms like Clio have brought large firm tools to small firm/sole practitioners, and greatly improved the toolkit available to lawyers. What these platforms don't offer, and what almost all online platforms (e.g. Facebook) don't offer, is local encryption (explained below). The current way of doing things is that lawyers are uploading important information about their clients to systems that they don't control, and that disclosure is often not mentioned in lawyers' retainer agreements. How does this interact with the rules for lawyers, such as the rules for confidentiality in Ontario? How should lawyers be safeguarding client information? The rest of this blog post talks about one possible way of addressing confidentiality in the era of cloud software tools for lawyers.

March 10th, 2019

Toronto Blockchain Week: April 22nd to 28th

Toronto will be celebrating Toronto Blockchain Week (TBW) from April 22nd till 28th. The website for TBW is https://www.torontoblockchainweek.io and the reaction to its launch last week has been very positive. Toronto has a lot to effort to the nascent blockchain industry.

March 6th, 2019

The Role of Stolen Payment Credentials in Crypto Banking Problems

The most common question I've heard from clients over the last five years of working with the crypto industry in Canada is: “How does my company get a bank account?”

One of the reasons why it's so hard to get a bank account for a cryptocurrency-related company is the prevalence in Canada of stolen payment credentials (debit/credit card information). Most people who I ask about this crime says it's happened to them. In a study by Canada's Chartered Professional Accountants, approximately 1/3 of Canadians said they'd been a victim of this crime. The rest of this blog post will explain how this commonplace crime is connected to the difficulties that companies have had in opening business bank accounts in the virtual currency (cryptocurrency) space.

February 6th, 2019

Blockchain Governance and the Public Interest Standard

Many concepts sound great in theory but become thorny in practice. One of those concepts is the idea of the "public interest". The term has existed as a principle for good government, in various forms, for thousands of years and it's widely used in law. In a recent blog post, a well-known Ethereum developer implicitly put forward the idea that public blockchains ought to be run in the "public interest". But what does the term mean and is that a standard that ought to be at the heart of Ethereum, or any other public blockchain? It's a concept that's widely used in law. Why not for Ethereum?

The term "public interest" appears in ethical guides, statutes, and administrative law textbooks all over the world. But this simple term hides a complicated reality. Few people agree on what the "public interest" is, how to identfiy it, or how to know when something isn't in the public interest. This is a standard that opens the door to debate, rather than providing a standard in the sense of Ethereum's ERC-20, technical standards, or really anything that programmers would say is a "standard". What lawyers and regulators call a "standard" might surprise people who are not familiar with the thousands of pages of scholarship on various sorts of "standards" in law (e.g. Canadian administrative law).

January 30th, 2019

Toronto's Blockchain Lawyers: A Growing List (January, 2019)

Toronto has an impressive and growing group of legal professionals who work in the blockchain space. This blog post is an attempt to list the people and their areas of focus (see the end of the table for the inclusion criteria and disclaimers).

| Lawyer's Name | % Blockchain (Approximate) | Brief Overview Of Their Blockchain Work |

|---|---|---|

| Aaron Grinhaus | 10-20 | Tax, securities and commercial law |

| Addison Cameron-Huff | 100 | Legal executive for blockchain companies (commercial/corporate) |

| Ana Badour | 15 | AML, payments law and financial services regulation |

| Binh Vu | More Than 10 | Companies going public and corporate financing |

| Chetan Phull | 95 | Regulations, cross-border operations, contracts, and disputes |

| Danny Kharazmi | 20 | Securities and corporate commercial law |

| Dean Masse | 25 | Legal advice for securities offerings |

| Evan Thomas | More Than 10 | Litigation, investigations and risk management |

| Geoff Cher | 20-50 | Financing, venture capital and securities compliance |

| Geoff Rawle | More Than 10 | Cross-border STOs, trading platforms, and funds work |

| Ian Palm | 20 | Capital raising, M&A and commercial advice |

| James Longwell | 10 | Protecting and reviewing blockchain intellectual property |

| Jason Saltzman | More Than 10 | Securities law and compliance matters |

| Laura Gheorghiu | 10 | Tax advice for Canadian tech companies |

| Lori Stein | 13.5 | Advises cryptoasset investment funds and managers |

| Marc Richardson Arnould | More Than 50 | Structuring, financing, acquisitions and dispositions |

| Marcus Hinkley | 15 | Capital markets and M&A |

| Myron Mallia-Dare | 15 | M&A, advises on technology matters & securities |

| Parna Sabet-Stephenson | 10-15 | Drafting and negotiating contracts |

| Phil Long | 15-20 | Capital raising, securities regulation and contract negotiations |

| Ross McKee | 10-20 | Regulatory advice for issuers, dealers & exchanges |

| Sam Ip | 15-20 | Commercial technology law, particularly open-source |

| Usman Sheikh | 90 | Securities litigation, professional liability and class actions |

| Zain Rizvi | More Than 10 | M&A, securities law, AML, and privacy |

January 25th, 2019

The Non-Fungible Token (NFT) License Agreement

Canadian company Dapper Labs Inc. has a new license to share with the world: version 2 of the "NFT License". This license relates to a special kind of Ethereum "token" pioneered by the company using their popular game/marketplace: CryptoKitties (further information here).

January 23rd, 2019

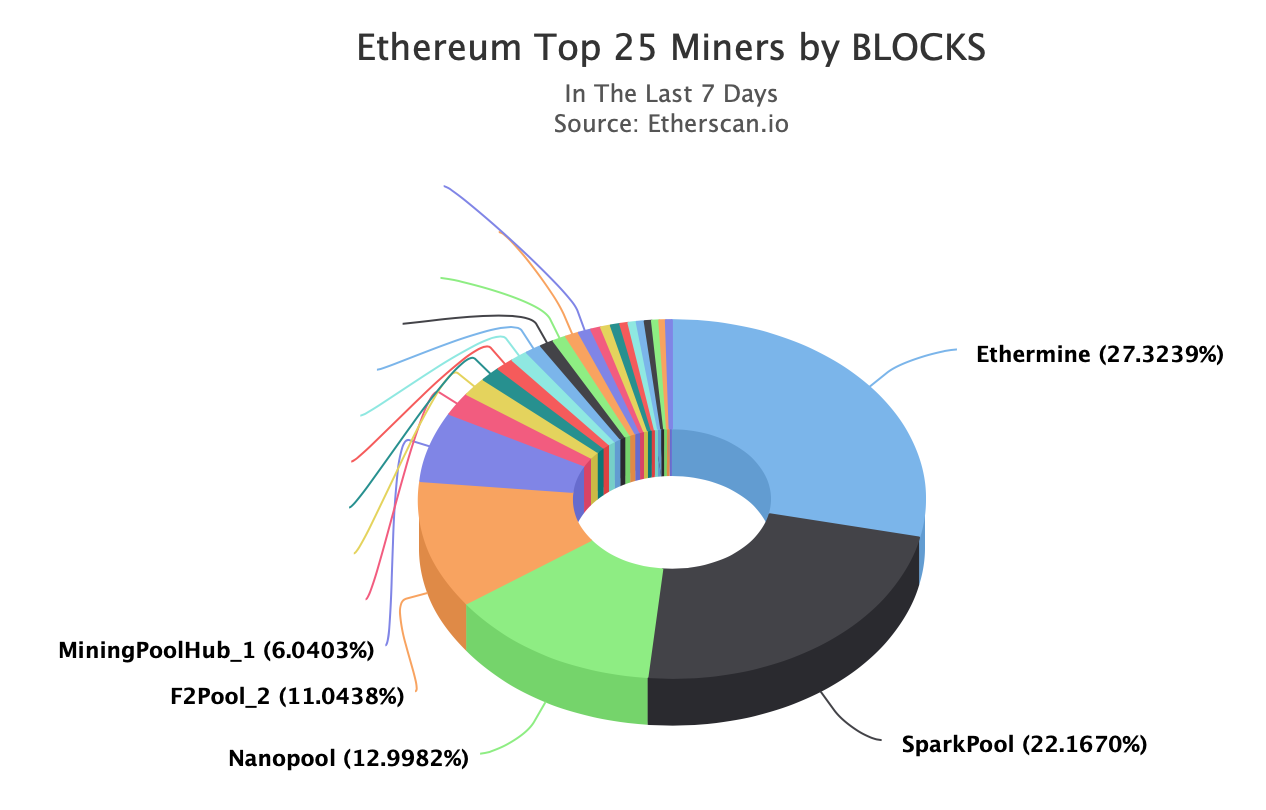

Who Manages Ethereum Mining? Are They A Good Target For Litigation Or Regulation?

Who runs Ethereum? Who's accountable for what happens on the Ethereum network? This is the first in a series of blog posts exploring this topic.

January 23rd, 2019

The FCA (UK) Is Consulting on Cryptoassets

The UK's financial industry regulatory body, the Financial Conduct Authority, is consulting on "cryptoasset" regulation until April. They've issued a document that contains their views on various aspects of the industry and how they might be regulated.