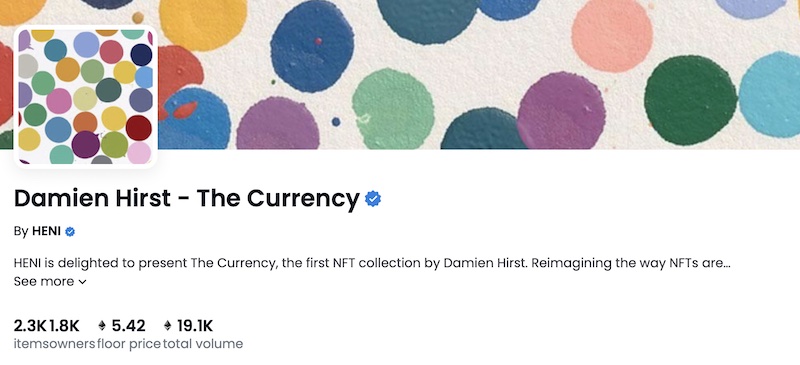

Cryptocurrency enthusiasts often describe its value proposition as being at least partly based on it being "decentralized". Cryptocurrencies are decentralized, it's true, but in a way that's more subtle than it might first seem. It's not the lack of a central bank or some other legal angle that makes cryptocurrency decentralized. It's also not in the activities that it's used for. It's decentralized because of its technical functioning. This is a bit challenging to understand from a cryptocurrency point of view, but recent developments in NFTs help make it more clear. More specifically, Damien Hirst's recent NFT collection called "The Currency" helps make the type of decentralization in cryptocurrency more clear.