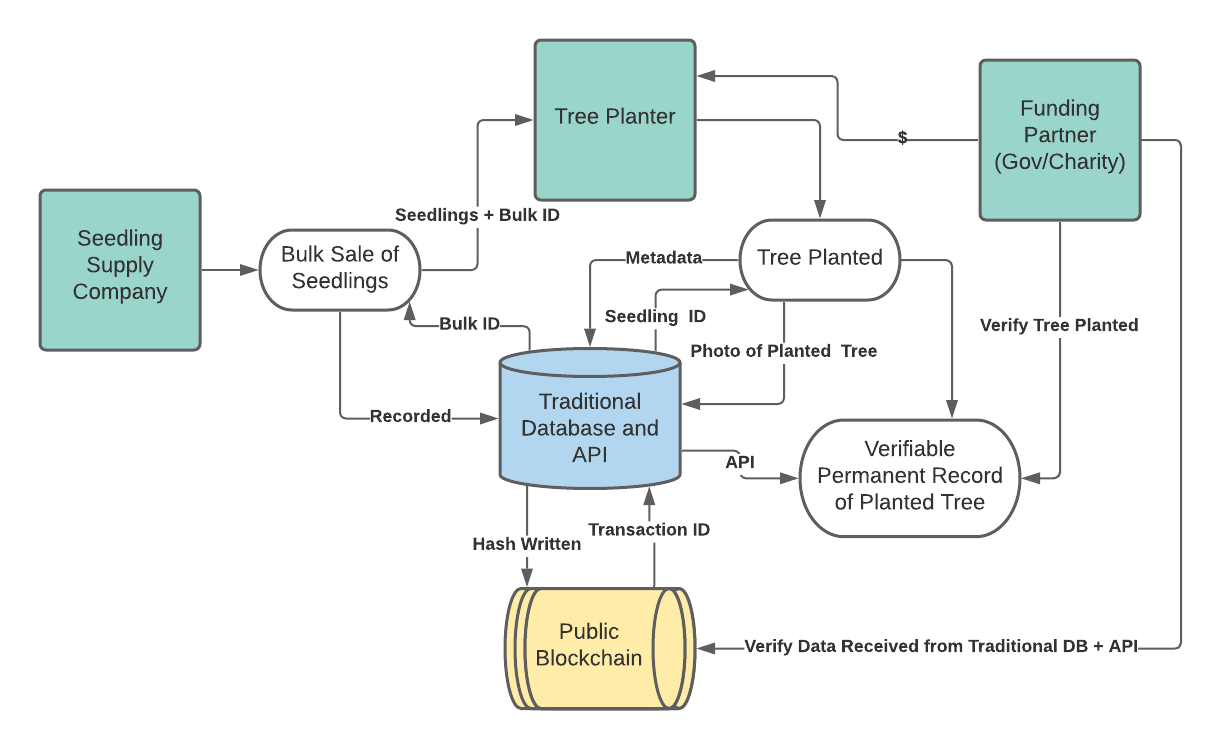

Government promises safety from the rough and tumble reality of life. This post is about the balance between protection and reward, and what that means in a globalized world in which Canadian services businesses are increasingly meeting with the opportunities & competition that manufacturers faced decades ago. Specifically, this post is in the context of moves to increase regulatory requirements for Canadian businesses in the cryptocurrency industry, but the issues aren't specific to cryptocurrency or blockchain technology.

Centuries ago, the government promise of safety meant protection from invasion by neighbouring warlords. Today, it means protection from all manner of harms. In Canada, the public demands safety at every turn and the government obliges. It does so by creating new rules and writing them down in uncountable laws, proclamations, guidance, and instructions. The Canadian public is always hopeful that if only one more rule could be created, they will be protected. And yes despite creating millions of rules, our government and its legal system have not eliminated frauds, scams, and cheating. Virtually everyone in Canada has been defrauded by someone. Sometimes the losses are life changing, and the stories are often heart breaking. I hear them from the people who regularly call me to see if a lawyer has the answer to what the government and basic decency failed to prevent. The answer is usually no.