Here are 54 ideas I've jotted down in my phone over the last couple years as business ideas. Some are good ideas and others aren't, but they might be food for thought that leads you to a great business concept.

Addison Cameron-Huff, Blockchain Lawyer

Thoughts and opinions of a Toronto-based cryptocurrency lawyer who's worked in the industry since 2014.

Follow @aCameronhuffSeptember 22nd, 2021

Exploring Law Firm Content: Blockchain Topics

Law firms generate large amounts of quality legal content that's often hard to find. They're not always the best at search engine optimization and the content is often not really designed to be easily consumed (it's for a niche audience). One of the main purposes of this content is to show who knows what they're talking about, because it's better to have an article showing that than a brief line in the bio of a lawyer saying it. But how can someone find which lawyers are good at what? How can that content be exposed? Are there ways of synthesizing this content or making it more readily available to the people it's designed for and others?

September 19th, 2021

Drafting Contracts For Cryptocurrency Clients

I've been drafting contracts with a heavy focus on cryptocurrency since 2014. This blog post gives a few tips I've picked up over the years.

Types of Contracts

April 22nd, 2021

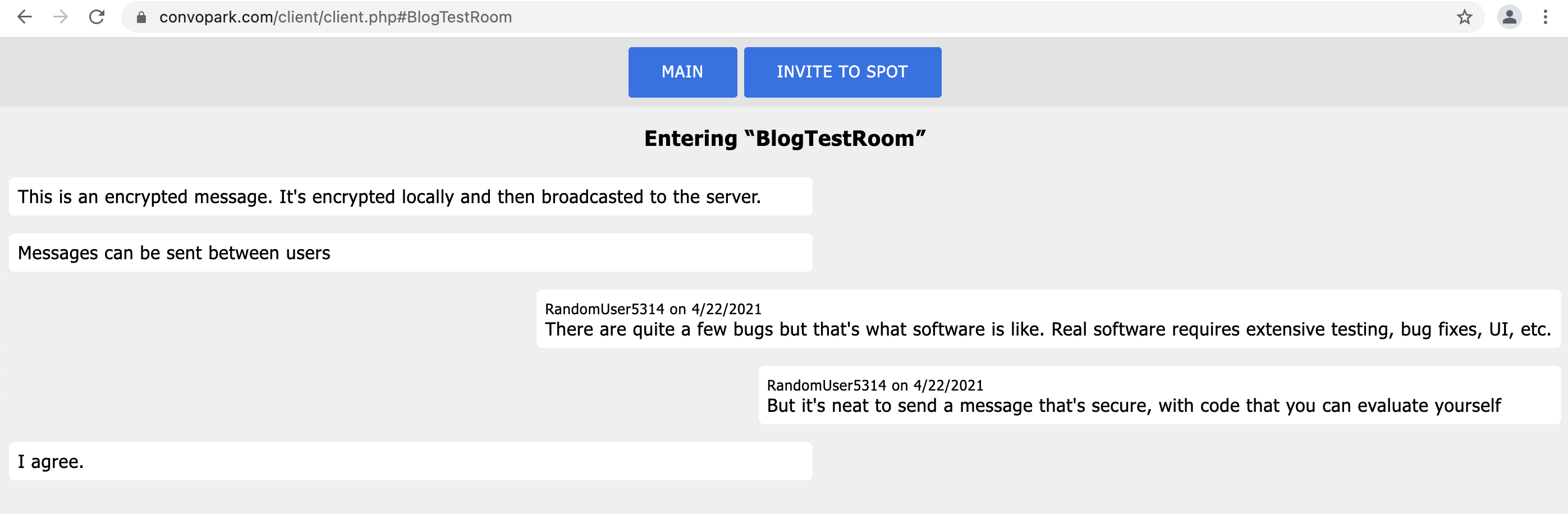

Local Encryption (E2E) for Lawyer Communications: ConvoPark Prototype

Confidentiality is key to the work of lawyers but most Internet-delivered services have no encryption other than transport encryption (HTTPS). This issue affects even the largest companies such as the 2020 Twitter account takeovers of Obama, Biden, Musk, and others, Snapchat employees looking at photos, the Canada Revenue Agency, and just about everyone else. The basic problem is that the data isn't encrypted so anyone with the right permissions at the company, or someone who can change permissions, can access all of the data. These sorts of services are the primary way that people interact with lawyers in 2021.

March 30th, 2021

Safety At What Cost: New Technologies, New Opportunities & New Risks

Government promises safety from the rough and tumble reality of life. This post is about the balance between protection and reward, and what that means in a globalized world in which Canadian services businesses are increasingly meeting with the opportunities & competition that manufacturers faced decades ago. Specifically, this post is in the context of moves to increase regulatory requirements for Canadian businesses in the cryptocurrency industry, but the issues aren't specific to cryptocurrency or blockchain technology.

Centuries ago, the government promise of safety meant protection from invasion by neighbouring warlords. Today, it means protection from all manner of harms. In Canada, the public demands safety at every turn and the government obliges. It does so by creating new rules and writing them down in uncountable laws, proclamations, guidance, and instructions. The Canadian public is always hopeful that if only one more rule could be created, they will be protected. And yes despite creating millions of rules, our government and its legal system have not eliminated frauds, scams, and cheating. Virtually everyone in Canada has been defrauded by someone. Sometimes the losses are life changing, and the stories are often heart breaking. I hear them from the people who regularly call me to see if a lawyer has the answer to what the government and basic decency failed to prevent. The answer is usually no.

March 18th, 2021

Canada's Blockchain Industry is Hiring: Jobs Available This Week

The blockchain space in Canada is booming and dynamic, being composed of many small to mid-sized players. This is great for competition but can make it difficult to find a position. Below are a few companies that are hiring right now (mostly remote positions).

Shakepay

March 8th, 2021

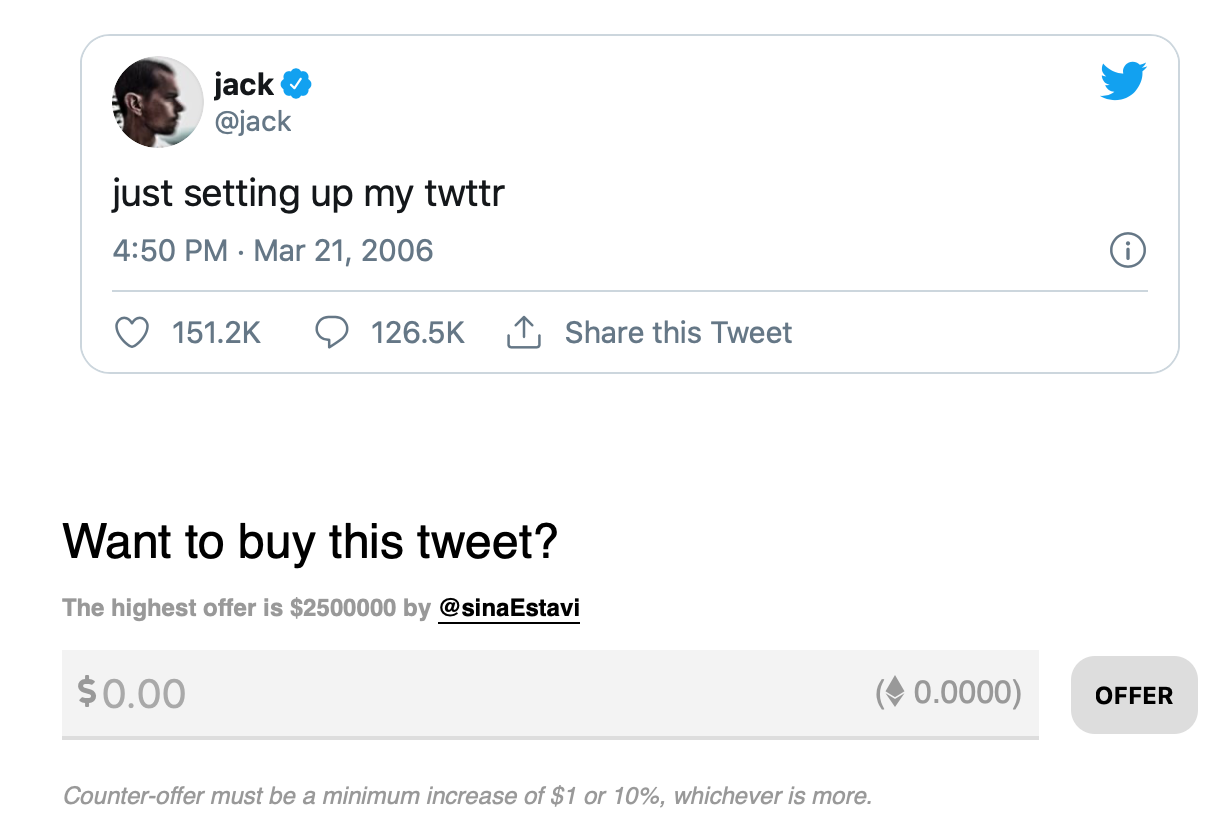

NFTs: The Art of Capitalism?

Jack Dorsey, the co-founder of Twitter, is selling his first tweet and the current highest bid is $2.5 million USD. Is the start of a new art of capitalism?

January 11th, 2021

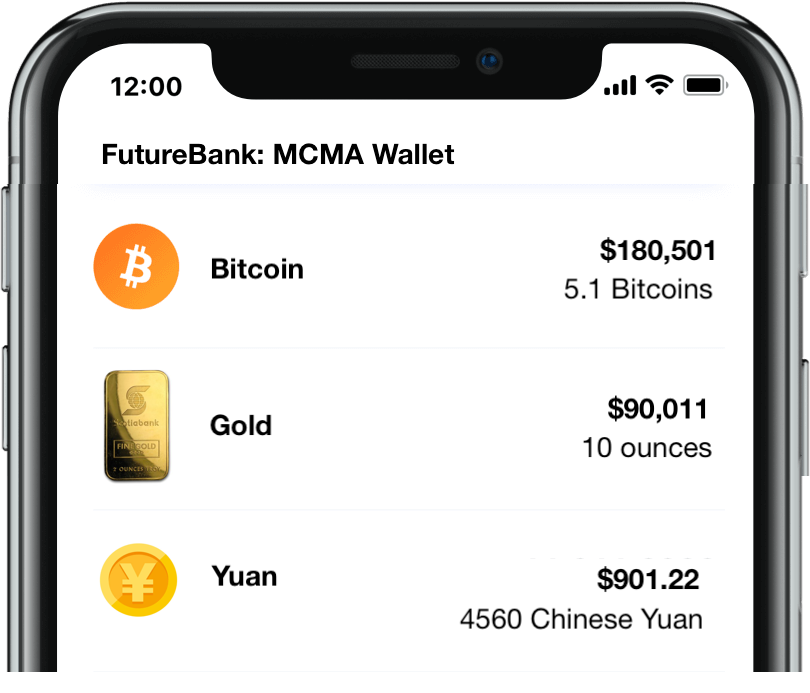

Is MCMA The Future Of Banking and Wealth Management? (Multi-Currency, Multi-Asset)

MCMA holds the promise of a world in which wealth management is diversified, cheap, and algorithmically driven. Imagine an app that allows you to allocate your money the way billionaires do, in a variety of different assets, and according to a professional, free strategy by a famous advisor.

January 7th, 2021

The $500 Million Per Year Business Waiting To Happen for Global Banks

Bitcoin and Ether are notoriously difficult to store securely and approaching the value of the global gold market. This is a $500 million a year business waiting to happen for one of Canada's big banks. Banks have the reputation, technical staff, security, and insurability, to become major players in the future market of storing cryptocurrency.

Cryptocurrencies liberate people from the need to use the financial system. There is no dependency on banks, except for exchanging to money, which largely relies on banks. But there's an opportunity for banks to go back to their roots as trusted places to store wealth. A Canadian bank could likely attract 5% of the world's cryptocurrency for storage if they could offer a secure, fast, insured service. It would immediately be used by institutional investors, high net worth individuals, and a significant portion of the individuals who hold smaller amounts of cryptocurrency.

December 8th, 2020

Seven Trends In Blockchain To Affect Canadian Regulation in 2021

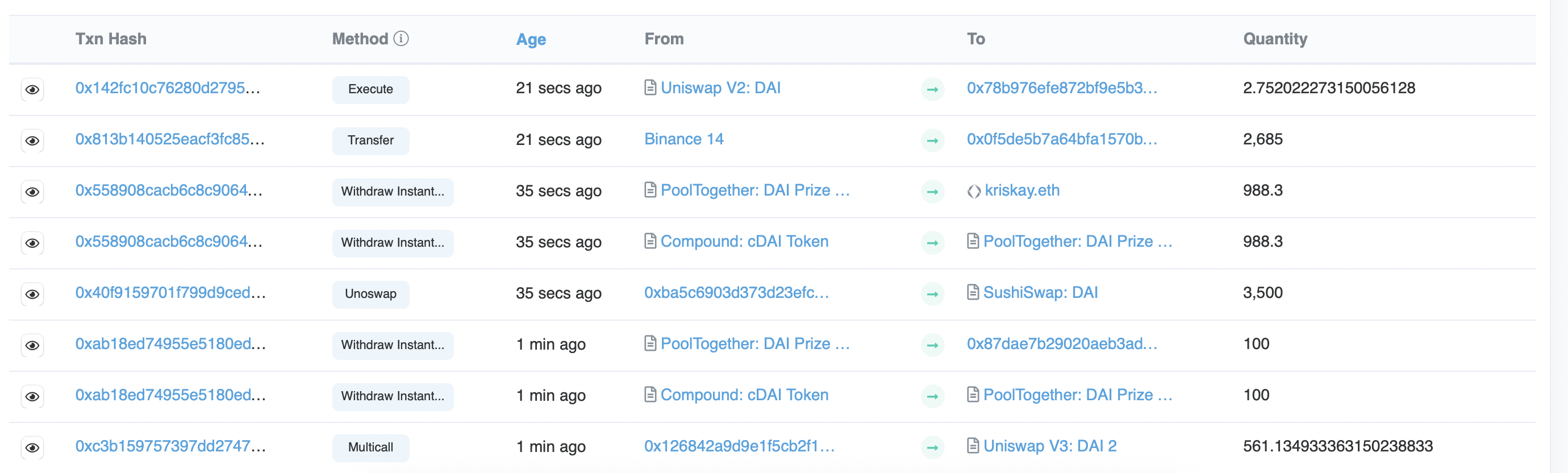

Here are seven trends happening in the world of blockchain that may affect Canadian and American regulation in the coming years: on-chain insurance, prediction markets, decentralized exchanges, collectibles, digital dollars, securitization and leverage.

November 16th, 2020

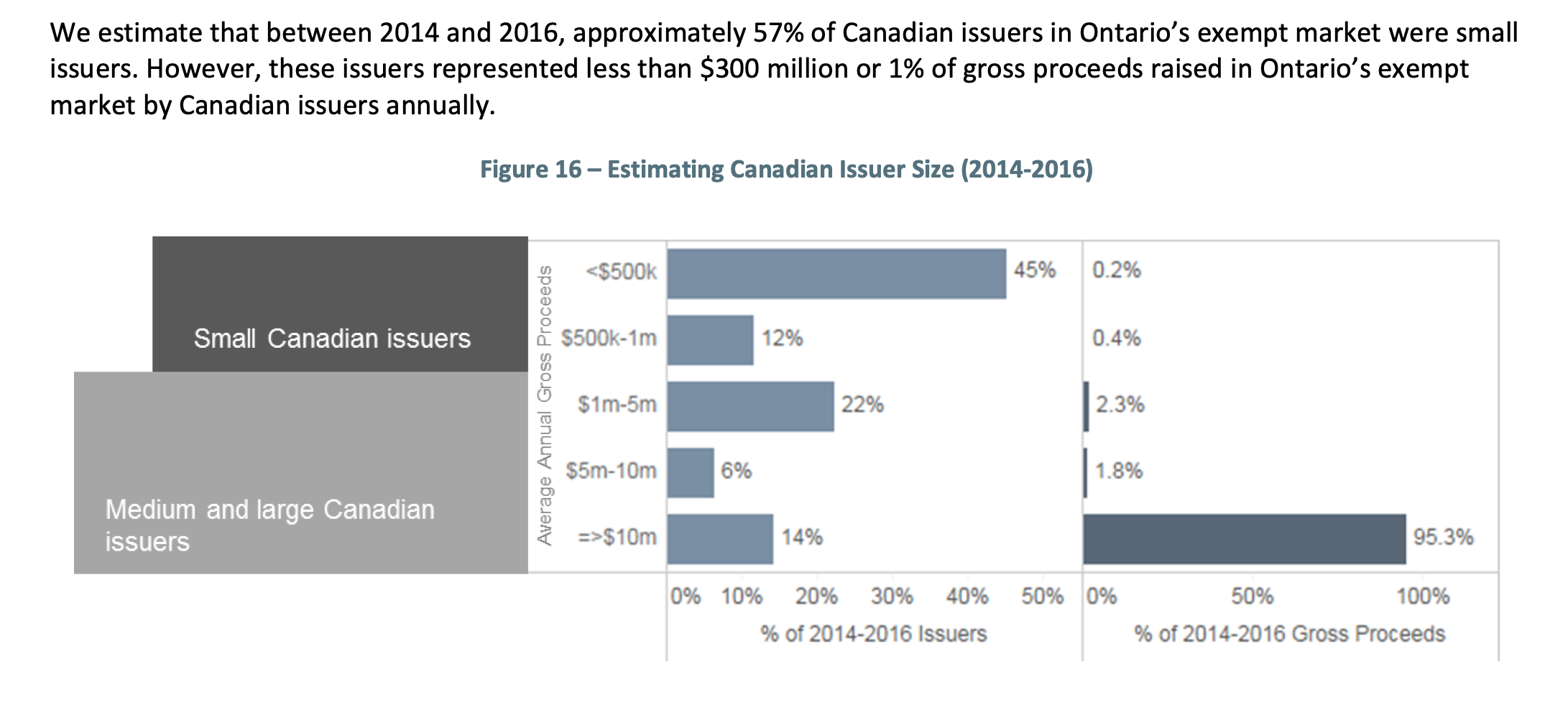

Solving the Small Issuer Problem in Ontario: The Key To COVID-19 Recovery?

Small businesses employ 70% of private sector employees in Canada. They're the lifeblood of employment, but also the key to a dynamic economy. That's fairly accepted in Canada politically and in the media. But what's not accepted is the role that investment laws play in restricting access to capital.

November 10th, 2020

Tech Law Drop-In Via Google Meet: Every Wednesday For 30 Days

I'm hosting a free weekly session for the next 30 days to answer and discuss legal questions. It'll be on Wednesdays from 10-12 EST on Google Meet (link below). Quite informal. The first one will be next Wednesday, November 18th.

November 8th, 2020

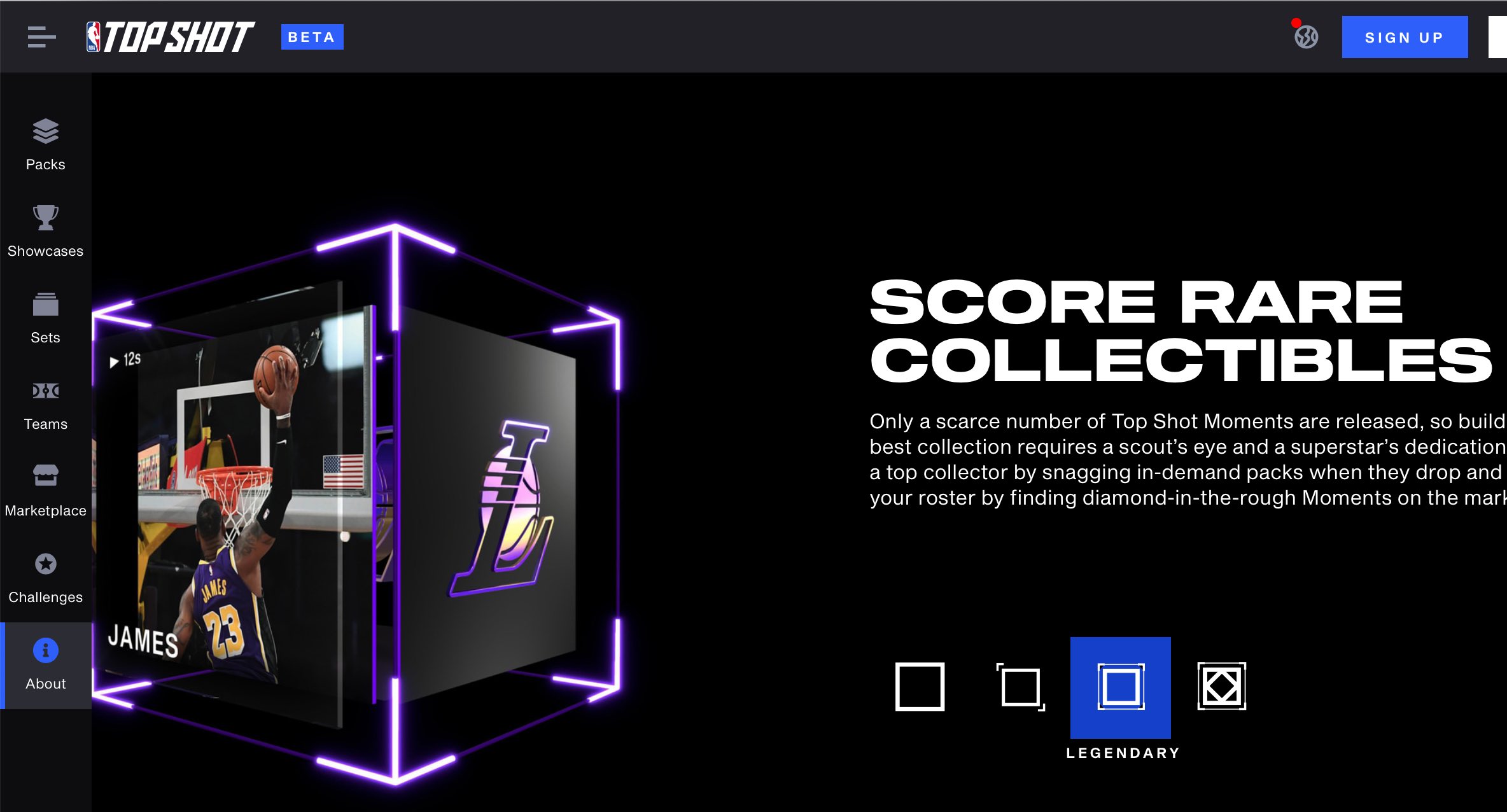

NBA Top Shot: NBA + Blockchain via Dapper Labs

The NBA has licensed their brand and content to Dapper Labs for a new type of collectible pack marketed as "Top Shot". Top Shot is like baseball cards, coming in digital foil packs, but with videos and a marketplace for trading. This is the evolution of a breakout hit CryptoKitties a couple years ago by the same developer. Now they've launched a produced in partnership with one of the biggest sports franchises.

November 8th, 2020

Better Tracking of Toxic Waste Using Public Digital Records

![]()

Blockchain-based systems with public open data records are one of the best ways to create a permanent, publicly-verifiable record of data. I've previously written about learning from supply chain/luxury brand work in blockchains, and how that could be applied in the context of tree planting and carbon trading. But these systems could also be used to better track pollution. Specifically, this approach could be used to upgrade the Canadian NPRI system.

October 30th, 2020

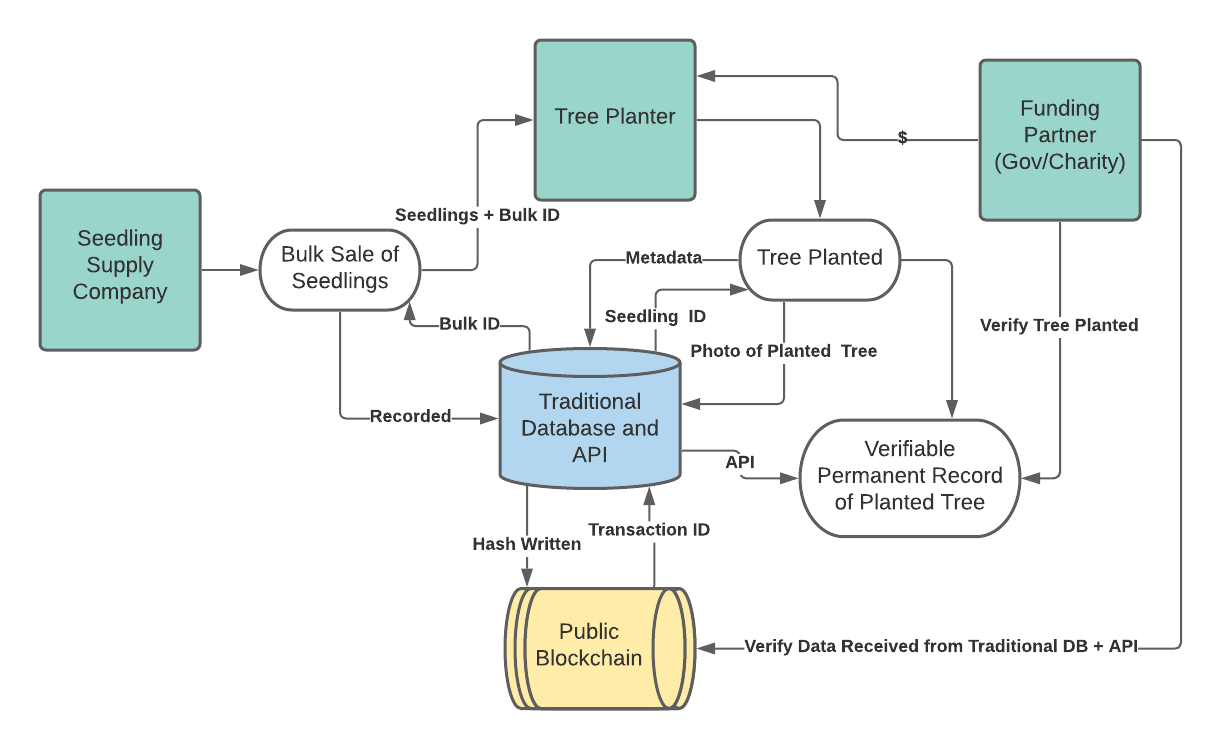

Luxury Brands Have Embraced Blockchain, Can It Be Done For The Environment?

Luxury brands like Breitling and Louis Vuitton have embraced the use of blockchain technology for anti-counterfeiting purposes. These approaches are now mature enough that, in conjunction with IoT and stablecoins, they could provide significant benefits for environmental initiatives. This article explains how these disparate technologies could be turned into real action that can increase public faith in environment-driven projects like carbon trading.

October 16th, 2020

How To Make A Search Engine for 750,000+ Pages From Government Websites: GorillaFind.com

Why Make A Search Engine?

There are many reasons to make a search engine but I have a specific need in mind: knowing about government changes. My law practice requires me to know about regulatory changes or legal developments in the area of virtual currency to within a day or two. Shouldn't every lawyer know about relevant changes as soon as they happen? The rest of this blog post explains my attempt to do this over the last year in my spare time on weekends, why this is an incredibly hard problem, and finally: some pointers for anyone who wants to try to do this. Below is a screenshot of the search engine I made.

September 8th, 2020

Canada's Money Supply, Coronavirus, and Bond Buying

Most media reports about the spending related to Coronavirus in Canada have focussed on the Government of Canada's enormous spending. But there's much quieter spending that's been taking place through the Bank of Canada, and some aspects of it, such as a large increase in the amount of money in Canada, the role of TD Bank, and large purchases of mortgages, have escaped notice. Bank of Canada assets and liabilities have increased by $430 billion in about six months. This deserves a lot more attention than the news has given it, and the specifics of some of the programs should give many Canadians pause as to whether their money is being wisely expended. Given the widespread suffering of people in Canada due to Coronavirus, there's an even greater duty for our government to be transparent about who has gained and lost through its spending, and how.

Money Supply: 3x, Balance Sheet: 5x

August 21st, 2020

A Canadian Crypto SRO

The Canadian cryptocurrency industry should be one of the strongest in the world, being the birthplace of Ethereum, close to the US market, a good bridge from China/HK, generous tax credits for R&D work, and many other advantages. But the industry has been plagued by a poor understanding of regulatory issues, unusual viewpoints put forward to government, and repeated work that ought to be shared. These problems could be addressed through the creation of a Canadian self-regulatory organization (SRO).

What would a crypto SRO do? Provide and enforce best practices, share knowledge, and boost the industry as a whole, to the benefit of its members and Canadians.

July 16th, 2020

Analysing Corporate Groups Through IP Filings: Me To We & The We Charity

My work often involves foreign companies that have unclear ownership structures that my clients would like to know more about. Given the ongoing scandal involving the We Charity, what can be learned by applying the same approach? What companies make up the We Charity and its related corporations? First the answer, then the method.

The Likely We Entities: 13 Corporations in Canada and the US

July 7th, 2020

COVID-19: We Should Not Impose Fines & Penalties During A Public Health Emergency

A senior lawyer I know recently posted on LinkedIn that they think people who don't wear masks should be charged with assault or maybe even "attempted murder". This wasn't a satirical post. My city councillor in Toronto, and all of the other city councillors, recently voted unanimously to bring in a penalty of at least $750 for not wearing a mask in a store, hotel elevator, church, and many other places in Toronto. That's approximately equal to one month of welfare payments in Ontario. This is not right, and I'm taking a break from my usual content about technology law to help bring a different perspective to this issue that I think has gone unnoticed in the panic over a virus that has killed hundreds of thousands of people worldwide.

People are scared and people have died. There's no understating the severity of this, but I'm thankful that the worst predictions of the pandemic haven't come true.